Trading & Brokerage

For custom requirements to address complex workflows, don't hesitate to contact us and explore the best solution to your specific need.

Check out our other solutions in a similar industry

The investment industry thrives on efficiency and accuracy. Algorythum’s automation solutions tackle common bottlenecks in portfolio management, trade execution, and client reporting, streamlining your workflow and freeing up valuable time for strategic analysis and client interaction.

Efficient Customer Inquiry and Complaint Management Automation for Investment Firms

Streamline Your Investment Customer Service: The Power of Customer Inquiry and Complaint Management Automation In today’s fast-paced investment landscape, providing exceptional customer service is paramount. However, managing customer inquiries and complaints can be a time-consuming and error-prone process, especially when done manually. Customer Inquiry and Complaint Management Automation using Python,

Accelerated Client Onboarding with Automated KYC and AML: Revolutionizing the Investment Industry

Embracing Automation for Seamless Client Onboarding and KYC/AML Compliance In the fast-paced investment industry, streamlining client onboarding and KYC/AML processes is paramount for efficiency and accuracy. Traditional manual methods are often time-consuming, prone to errors, and can delay account activation. Client Onboarding and KYC and AML Automation using Python, AI,

Transforming Back-Office Reconciliation with High-capacity Automation

Back-Office Reconciliation Automation: Unlocking Efficiency and Accuracy in the Investment Industry The financial services industry, particularly the investment sector, heavily relies on accurate and timely reconciliation of data between front-office trading systems and back-office accounting systems. Back-office reconciliation automation has emerged as a transformative solution to address the challenges of

Top-notch Regulatory Research and Update Automation

Regulatory Research and Update Automation: A Path to Efficiency and Compliance In the fast-paced world of investment, staying abreast of regulatory changes is paramount for ensuring compliance and maintaining operational efficiency. Manual regulatory research and update processes are often time-consuming, error-prone, and can lead to critical oversights. Embracing Automation with

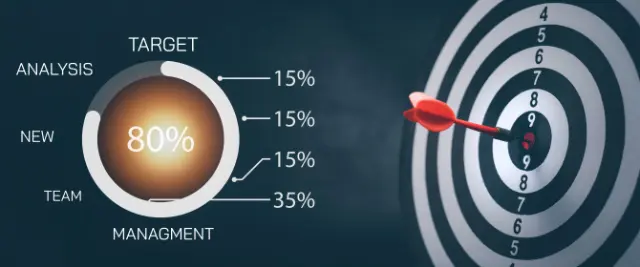

High-end Best Execution Analysis Automation: Enhancing Investment Performance

Embracing Intelligent Automation for Best Execution Analysis: A Game-Changer for the Investment Industry In the dynamic world of finance, ensuring best execution practices is paramount to safeguarding client interests and maximizing investment returns. Best execution analysis, however, is a complex and time-consuming process, often hindered by manual data gathering and

Enhanced Client Account Activity Reporting Automation: Driving Transparency and Investment Portfolio Analysis

Client Account Activity Reporting Automation: Enhancing Transparency and Investment Analysis In the fast-paced world of investment, accurate and timely client account activity reporting is crucial for building trust, ensuring transparency, and empowering clients to make informed decisions. However, manual reporting processes can be prone to errors, time-consuming, and lack the

High-performance Risk Monitoring and Alerting Automation for Investment Firms

Risk Monitoring and Alerting Automation: A Vital Investment for Investment Firms In the fast-paced world of investment, risk monitoring and alerting are critical to safeguarding assets and maintaining regulatory compliance. Traditional methods of risk management are often manual and time-consuming, leading to potential delays in identifying and addressing risks. Risk

Comprehensive and Compliant Regulatory Reporting Automation for the Investment Industry

Overcoming Regulatory Reporting Challenges with AI-Powered Automation In the ever-evolving investment landscape, regulatory reporting has become an increasingly complex and time-consuming task. Investment firms face the daunting challenge of adhering to a myriad of exchange and industry regulations, while ensuring accuracy and minimizing compliance errors. Regulatory Reporting Automation offers a

Streamline Corporate Action Processing with Advanced Automation

Embrace Efficiency: Corporate Action Processing Automation for the Investment Industry Corporate action processing is a crucial yet complex task in the investment industry, involving the handling of events such as stock splits, dividends, and mergers. Manual processing of these actions is prone to errors, delays, and inefficiencies. Corporate Action Processing

Streamline Commission and Fee Calculations with Automated Precision

Revolutionizing Commission and Fee Calculations: A Path to Precision and Efficiency The investment industry relies heavily on accurate and timely commission and fee calculations to ensure proper client billing and maintain regulatory compliance. However, manual calculations can be tedious, error-prone, and time-consuming, leading to inefficiencies and potential financial losses. Commission

Resilient Trade Confirmation and Settlement Automation: Revolutionizing Post-Trade Operations in Investment

Embracing Intelligent Trade Confirmation and Settlement Automation In the fast-paced world of investment, streamlining post-trade operations is crucial for efficiency and accuracy. Traditional manual processes for trade confirmation and settlement can be cumbersome, prone to errors, and delay client fund movement. Enter Trade Confirmation and Settlement Automation, a revolutionary approach

Margin Call Processing Automation: Revolutionizing Investment Risk Management

Humanizing Margin Call Processing: Enhancing Efficiency and Mitigating Risk Margin calls can be a stressful experience for investment firms, triggering a cascade of time-sensitive actions that require precision and speed. Margin Call Processing Automation offers a lifeline, streamlining the entire process and empowering firms to respond swiftly and effectively. By

High-end Position Reconciliation Automation for Investment Firms

Position Reconciliation Automation: A Lifeline for the Investment Industry The investment industry is a complex and fast-paced environment, where accurate and timely position reconciliation is crucial for portfolio accuracy and risk management. However, manual position reconciliation is a tedious and error-prone process, often involving multiple systems and data sources. Position

High-tech Market Data Monitoring Automation

Empowering Investment Professionals with Intelligent Market Data Monitoring Automation Market data monitoring is a critical yet challenging aspect of investment management. The sheer volume and complexity of real-time market data can overwhelm analysts, leading to missed opportunities and suboptimal decision-making. Market Data Monitoring Automation addresses this challenge by leveraging the

Advanced Order Entry and Management Automation for the Investment Industry

Revolutionizing Order Entry and Management with Intelligent Automation Introduction In the fast-paced and competitive world of investment, efficiency and accuracy are paramount. Order entry and management processes play a crucial role in driving success, but they often face challenges that hinder optimal performance. Order Entry and Management Automation emerges as

Unveiling More Automations Soon. Stay Tuned!

Leave Competitors Behind

Let's stay in touch

Get exclusive access to groundbreaking automations in your industry delivered straight to your inbox.

*We never spam and send only your chosen industry news.