Loan Servicing Automation: Humanizing the Lending Process with Python, AI, and the Cloud

Loan servicing, the backbone of the lending industry, often involves a myriad of repetitive and time-consuming tasks that can hinder efficiency and accuracy. Loan Servicing Automation emerges as the beacon of hope, offering lenders a transformative solution to streamline operations and enhance the customer experience.

Harnessing the power of Python, AI, and cloud-based solutions, Loan Servicing Automation empowers lenders to automate mundane tasks such as updating customer records, responding to inquiries, and processing loan modifications. This not only reduces the risk of human error but also frees up valuable time for loan officers to focus on more strategic initiatives, fostering stronger relationships with borrowers.

By embracing Loan Servicing Automation, lenders can:

- Enhance operational efficiency and reduce costs

- Improve accuracy and compliance

- Provide exceptional customer service

- Gain valuable insights for informed decision-making

Join the automation revolution and transform your loan servicing operations with Loan Servicing Automation. Experience the transformative power of technology that empowers both lenders and borrowers, forging a path towards a more efficient and humanized lending ecosystem.

Python, AI, and the Cloud: The Power Trio for Loan Servicing Automation

Loan Servicing Automation has emerged as a game-changer in the lending industry, and Python, AI, and cloud-based solutions are the driving forces behind its transformative power.

Python for Unattended and Attended Bots

Python’s versatility shines in developing both unattended and attended bots for Loan Servicing Automation:

- Unattended bots: These bots work autonomously, automating repetitive tasks such as data entry, report generation, and loan processing. Python’s robust libraries and frameworks make it easy to build efficient and scalable bots.

- Attended bots: Unlike their unattended counterparts, attended bots collaborate with human loan officers, providing real-time assistance and automating specific tasks within the loan servicing process. Python’s flexibility allows for deep customization, enabling bots to adapt to the unique needs of each loan officer.

Cloud Platforms: The Orchestration Powerhouse

Cloud platforms offer a comprehensive suite of features and capabilities that far surpass traditional RPA/workflow tools orchestrators. These platforms provide:

- Centralized management: Manage all automations from a single, cloud-based dashboard.

- Scalability and elasticity: Easily scale automations up or down based on demand, ensuring seamless performance.

- Advanced analytics and reporting: Gain valuable insights into automation performance and identify areas for improvement.

AI for Accuracy and Edge-Case Handling

AI plays a pivotal role in enhancing the accuracy and efficiency of Loan Servicing Automation:

- Image recognition: Automate document processing by extracting data from loan applications, invoices, and other documents.

- Natural language processing (NLP): Analyze customer inquiries and extract key information, enabling automated responses and improved customer service.

- Generative AI: Generate personalized loan offers, risk assessments, and compliance reports, saving time and reducing errors.

By harnessing the power of Python, AI, and the cloud, lenders can unlock the full potential of Loan Servicing Automation, transforming their operations and delivering an exceptional customer experience.

Building the Loan Servicing Automation with Python and the Cloud

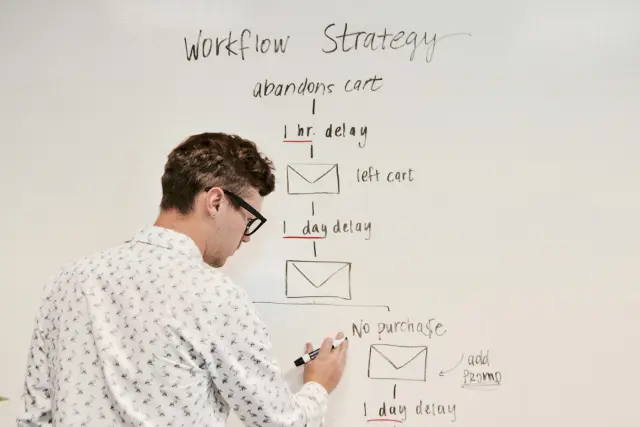

Loan Servicing Automation involves a series of interconnected processes that can be automated using Python and cloud-based solutions. Here’s a step-by-step guide to building these automations:

1. Process Analysis

Analyze the existing loan servicing processes to identify tasks that are repetitive, time-consuming, or error-prone. Prioritize these tasks for automation.

2. Python Script Development

Develop Python scripts to automate each identified task. Utilize Python’s libraries for data manipulation, web scraping, and API integration.

3. Cloud Deployment

Deploy the Python scripts to a cloud platform for centralized management, scalability, and security.

4. Data Security and Compliance

Implement robust data security measures to protect sensitive customer information. Ensure compliance with industry regulations and best practices.

Python vs. No-Code RPA/Workflow Tools

While no-code RPA/workflow tools offer a low-code/no-code approach, they often lack the flexibility and customization capabilities of Python. Python provides:

- Greater control: Direct access to the underlying code allows for fine-tuning and optimization of automations.

- Flexibility: Python’s versatility enables the automation of complex processes and edge cases that may not be supported by pre-built tools.

- Integration: Python seamlessly integrates with other technologies and systems, allowing for end-to-end automation.

Algorythum’s Approach

At Algorythum, we recognize the limitations of off-the-shelf automation platforms. Our Python-based approach empowers lenders with:

- Tailor-made solutions: Custom-built automations that cater to the unique needs of each lender.

- Scalability and performance: Cloud-based deployment ensures seamless handling of high-volume workloads.

- Continuous improvement: Regular updates and enhancements to keep automations aligned with evolving industry trends and regulations.

By partnering with Algorythum, lenders can harness the power of Python and the cloud to build robust and scalable Loan Servicing Automation solutions that drive efficiency, accuracy, and customer satisfaction.

The Future of Loan Servicing Automation

The convergence of Python, AI, and the cloud has opened up a world of possibilities for Loan Servicing Automation. Here are some potential future enhancements to the proposed solution:

- Cognitive Automation: Integrate cognitive technologies, such as natural language understanding and machine learning, to automate complex decision-making processes and provide personalized customer experiences.

- Blockchain Integration: Leverage blockchain technology to create a secure and transparent system for loan record-keeping and tracking.

- Robotic Process Mining (RPM): Utilize RPM to analyze and optimize existing loan servicing processes, identifying additional areas for automation.

Subscribe to Algorythum

Stay ahead of the curve by subscribing to our newsletter. Receive industry-specific automation insights, best practices, and exclusive updates on the latest Loan Servicing Automation advancements.

Contact Us

Ready to transform your loan servicing operations? Contact our team today for a free feasibility assessment and cost estimate. Let us tailor a Loan Servicing Automation solution that meets your unique requirements and drives your business success.

Together, let’s shape the future of Loan Servicing Automation and elevate the lending experience for both lenders and borrowers.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.