Cash Transfer Processing Automation: Empowering Investors with Efficiency and Accuracy

In the dynamic world of investment, time is of the essence. Investors demand seamless and efficient processes that empower them to make informed decisions and execute transactions swiftly. Cash transfer processing, a crucial aspect of investment management, has traditionally been a manual and error-prone task. However, with the advent of Cash Transfer Processing Automation, powered by Python, AI, and cloud-based solutions, investment firms can now unlock a new era of efficiency, accuracy, and convenience.

Cash Transfer Processing Automation streamlines the process of transferring funds between investment accounts and external bank accounts, eliminating the need for manual intervention. This Cash Transfer Processing Automation not only saves time but also reduces the risk of errors, ensuring that investors’ funds are transferred securely and accurately.

Python, AI, and Cloud: The Cornerstones of Cash Transfer Processing Automation

Unattended Bots: Automating the Night Shift

Python is the language of choice for developing unattended bots that can automate repetitive and time-consuming tasks, such as cash transfer processing. These bots can run 24/7, tirelessly processing transactions without the need for human intervention. By leveraging Python’s powerful libraries and frameworks, investment firms can create custom bots that meet their specific requirements.

Attended Bots: Enhancing Human Efficiency

Attended bots are designed to assist human workers by automating specific tasks within a workflow. In the context of cash transfer processing, attended bots can guide users through the transfer process, verify data, and even execute transactions with human oversight. Python’s flexibility and ease of integration make it an ideal language for building attended bots that seamlessly integrate with existing systems.

Cloud Platforms: Orchestrating Automation at Scale

Cloud platforms offer a comprehensive suite of tools and services that empower investment firms to orchestrate automation at scale. These platforms provide robust infrastructure, advanced security features, and powerful automation capabilities that far surpass traditional RPA/workflow tools. By leveraging cloud platforms, investment firms can centralize automation management, gain real-time visibility into processes, and scale their automation efforts as needed.

AI: Enhancing Accuracy and Handling Edge Cases

AI plays a crucial role in improving the accuracy and efficiency of cash transfer processing automation. Techniques such as image recognition can automate the extraction of data from physical documents, while natural language processing (NLP) can interpret unstructured text and handle complex instructions. Generative AI can even be used to generate automated responses and provide personalized recommendations. By incorporating AI into their automation strategies, investment firms can enhance the accuracy of transactions, reduce the risk of errors, and improve the overall investor experience.

Building the Cash Transfer Processing Automation with Python and Cloud

Sub-Processes Involved in Cash Transfer Processing Automation

The cash transfer processing automation process can be broken down into several key sub-processes:

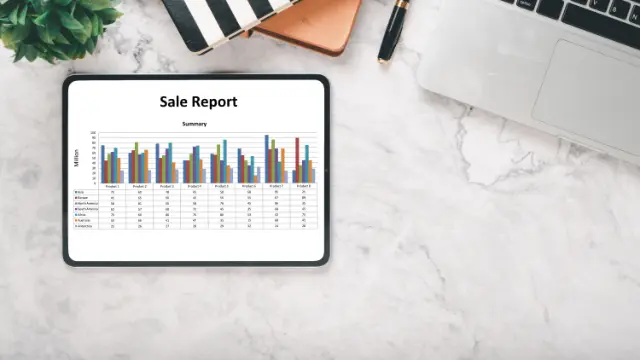

- Data Extraction: Extracting data from various sources, such as spreadsheets, emails, and online portals.

- Data Validation: Verifying the accuracy and completeness of the extracted data.

- Transaction Execution: Initiating and executing cash transfer transactions.

- Confirmation and Reconciliation: Confirming the successful transfer of funds and reconciling transactions.

Automating Sub-Processes with Python and Cloud

1. Data Extraction: Python’s powerful libraries, such as Pandas and BeautifulSoup, can be used to extract data from a variety of sources. Cloud platforms provide scalable infrastructure and data storage solutions to handle large volumes of data.

2. Data Validation: Python’s data validation libraries can be used to check for missing or invalid data. Cloud platforms offer data quality tools that can further enhance data validation and ensure data integrity.

3. Transaction Execution: Python can be used to integrate with financial institutions’ APIs to initiate and execute cash transfer transactions. Cloud platforms provide secure and reliable infrastructure for transaction processing.

4. Confirmation and Reconciliation: Python can be used to monitor transaction statuses and send confirmation notifications. Cloud platforms offer tools for data reconciliation and auditing, ensuring the accuracy and completeness of transactions.

Importance of Data Security and Compliance

Data security and compliance are paramount in the investment industry. Python provides robust encryption and authentication mechanisms to protect sensitive financial data. Cloud platforms offer industry-leading security features and compliance certifications, ensuring that data is protected and handled in accordance with regulatory requirements.

Advantages of Python over No-Code RPA/Workflow Tools

1. Flexibility and Customization: Python is a versatile language that allows for highly customized automation solutions. No-code RPA/workflow tools often have limited customization options, which can restrict the scope of automation.

2. Scalability and Performance: Python can handle large volumes of data and complex processes efficiently. No-code RPA/workflow tools may struggle with scalability and performance limitations.

3. Integration and Interoperability: Python can easily integrate with a wide range of systems and applications. No-code RPA/workflow tools may have limited integration capabilities, hindering the automation of end-to-end processes.

Algorythum’s Approach: Python-Based Automation

Algorythum takes a different approach to automation, focusing on Python-based solutions rather than pre-built RPA tools. This approach is driven by our commitment to providing clients with the following benefits:

- Customized and Scalable Solutions: Python allows us to tailor automation solutions to the specific needs of each client, ensuring maximum efficiency and scalability.

- Improved Performance and Reliability: Python’s powerful capabilities enable us to build high-performance automation systems that can handle complex processes and large volumes of data.

- Reduced Costs and Time-to-Market: By leveraging Python’s open-source nature and rapid development capabilities, we can deliver cost-effective automation solutions with faster time-to-market.

The Future of Cash Transfer Processing Automation

The future of cash transfer processing automation holds exciting possibilities for further enhancing the efficiency and convenience of investment operations. Here are a few potential extensions to the proposed solution:

- Integration with Cognitive Technologies: Cognitive technologies, such as machine learning and natural language processing, can be leveraged to automate complex decision-making processes and provide personalized recommendations to investors.

- Blockchain Integration: Blockchain technology can be used to create secure and transparent records of cash transfer transactions, enhancing trust and reducing the risk of fraud.

- Robotic Process Automation (RPA): RPA bots can be integrated with the automation solution to automate repetitive and manual tasks, such as data entry and reconciliation.

Subscribe and Contact Us

To stay updated on the latest trends and advancements in investment automation, subscribe to our newsletter.

If you are interested in implementing a custom cash transfer processing automation solution for your investment firm, please contact our team. We offer a free feasibility assessment and cost estimate to help you determine the best approach for your specific requirements.

Together, we can unlock the full potential of automation to streamline your cash transfer processes, enhance efficiency, and provide a superior experience for your investors.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.