Embracing Regulatory Reporting Automation: A Path to Compliance and Efficiency

In the ever-evolving investment industry, regulatory reporting is a crucial yet often burdensome task. The manual preparation and submission of reports can be time-consuming, prone to errors, and a drain on resources. Regulatory Reporting Automation offers a transformative solution, leveraging the power of Python, AI, and cloud-based technologies to streamline this process and empower investment firms to achieve compliance with greater efficiency and accuracy.

Regulatory Reporting Automation enables the automation of data extraction, report generation, and submission processes. By leveraging Python’s versatility and AI’s analytical capabilities, firms can automate complex tasks such as data validation, anomaly detection, and report customization. This not only reduces manual effort but also improves accuracy and ensures timely submission.

Moreover, cloud-based solutions provide a scalable and secure platform for regulatory reporting automation. Firms can access these solutions on-demand, eliminating the need for costly hardware investments and maintenance. Cloud-based platforms also facilitate collaboration and data sharing among teams, further enhancing efficiency and streamlining the overall reporting process.

Python, AI, and Cloud: The Cornerstones of Regulatory Reporting Automation

Python: The Versatile Automation Language

Python’s versatility makes it an ideal choice for Regulatory Reporting Automation. Its extensive libraries and frameworks simplify the development of both unattended and attended bots.

Unattended bots can be programmed to execute repetitive tasks without human intervention. They can automate data extraction from various sources, validate data, and generate reports according to predefined rules. This eliminates the need for manual data entry and reduces the risk of errors.

Attended bots assist human users in completing tasks by providing real-time guidance and automating specific steps. In Regulatory Reporting Automation, attended bots can assist compliance officers in reviewing and approving reports before submission. Python’s flexibility allows for a high level of customization, enabling bots to adapt to specific business processes and regulatory requirements.

Cloud Platforms: Scalable and Secure Automation Orchestrators

Cloud platforms offer a comprehensive suite of features that surpass traditional RPA/workflow tools. They provide:

- Scalability: Cloud platforms can handle large volumes of data and support multiple concurrent automation tasks.

- Security: Cloud platforms implement robust security measures to protect sensitive data and ensure compliance with regulatory standards.

- Collaboration: Cloud-based automation solutions facilitate collaboration among teams, enabling seamless data sharing and centralized management of automation processes.

AI: Enhancing Accuracy and Handling Edge Cases

AI techniques play a crucial role in Regulatory Reporting Automation by improving accuracy and handling edge cases.

- Image recognition: AI algorithms can analyze images and extract relevant data, such as signatures or watermarks, from regulatory reports.

- Natural language processing (NLP): NLP techniques can be used to extract insights from unstructured text, such as identifying key terms or classifying documents.

- Generative AI: Generative AI models can assist in report generation by creating compliant and accurate reports based on predefined templates.

By leveraging these AI techniques, Regulatory Reporting Automation can become more sophisticated and effective, reducing the need for manual intervention and ensuring compliance with complex regulatory requirements.

Building the Regulatory Reporting Automation: A Step-by-Step Guide

Sub-Processes and Automation with Python and Cloud

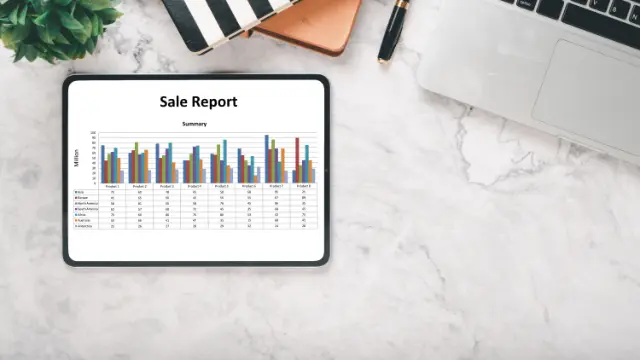

1. Data Extraction:

– Use Python libraries to extract data from various sources, such as databases, spreadsheets, and web pages.

– Leverage cloud-based data storage and processing services to handle large volumes of data efficiently.

2. Data Validation:

– Implement Python scripts to validate data accuracy and completeness.

– Use cloud-based machine learning models to identify anomalies and outliers.

3. Report Generation:

– Utilize Python’s templating engines to generate reports in the required format.

– Integrate with cloud-based document management systems for secure storage and retrieval of reports.

4. Report Submission:

– Automate report submission to regulatory bodies using Python’s networking libraries.

– Leverage cloud-based workflow automation tools to orchestrate the submission process.

Data Security and Compliance

Data security and compliance are paramount in Regulatory Reporting Automation. Python provides robust encryption and authentication mechanisms to protect sensitive data. Cloud platforms offer secure infrastructure and compliance certifications to ensure adherence to industry standards.

Python vs. No-Code RPA/Workflow Tools

Python offers several advantages over no-code RPA/workflow tools for Regulatory Reporting Automation:

- Flexibility: Python’s open-source nature and extensive ecosystem allow for customization and integration with various technologies.

- Control: Developers have complete control over the automation process, enabling fine-tuning and optimization.

- Scalability: Python can handle complex and large-scale automation tasks, making it suitable for enterprise-level deployments.

Algorythum’s Approach

Algorythum recognizes the limitations of off-the-shelf automation platforms and takes a different approach. By leveraging Python and cloud technologies, we deliver tailored Regulatory Reporting Automation solutions that:

- Meet specific regulatory requirements: We customize our solutions to align with the unique needs of each client and industry.

- Provide end-to-end automation: Our solutions cover the entire regulatory reporting process, from data extraction to report submission.

- Ensure accuracy and compliance: We prioritize data validation and compliance checks to guarantee the accuracy and integrity of reports.

Our Python-based approach empowers investment firms to achieve greater efficiency, reduce compliance risks, and gain a competitive edge in the rapidly evolving regulatory landscape.

Regulatory Reporting Automation: The Future

The future of Regulatory Reporting Automation holds exciting possibilities for further enhancing the efficiency and accuracy of regulatory compliance.

- Integration with Cognitive Technologies: Advances in cognitive technologies, such as natural language processing and machine learning, will enable automation to handle more complex tasks, such as interpreting regulatory text and identifying trends in regulatory data.

- Real-Time Reporting: Automation can be extended to enable real-time reporting, providing regulators with up-to-date insights into market activities and reducing the risk of regulatory breaches.

- Predictive Analytics: By leveraging predictive analytics, automation can identify potential compliance issues and recommend proactive measures to mitigate risks.

Subscribe and Contact Us

To stay updated on the latest trends and innovations in automation for the investment industry, subscribe to our newsletter.

For a free feasibility assessment and cost estimate for your custom Regulatory Reporting Automation requirements, contact our team today. Let us help you streamline your compliance processes, reduce manual effort, and gain a competitive advantage in the digital age.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.