Back-Office Reconciliation Automation: Unlocking Efficiency and Accuracy in the Investment Industry

The financial services industry, particularly the investment sector, heavily relies on accurate and timely reconciliation of data between front-office trading systems and back-office accounting systems. Back-office reconciliation automation has emerged as a transformative solution to address the challenges of manual reconciliation processes, which are prone to errors, time-consuming, and labor-intensive.

With the advent of Python, artificial intelligence (AI), and cloud-based technologies, back-office reconciliation automation has become a reality. Businesses can leverage these advancements to streamline and enhance their reconciliation processes, resulting in significant efficiency gains and improved data integrity.

Embracing automation in back-office reconciliation not only reduces the risk of errors but also frees up valuable human resources to focus on more strategic tasks. By implementing automation, investment firms can gain a competitive edge by optimizing their operations, enhancing accuracy, and driving informed decision-making.

Python, AI, and Cloud’s Role in Back-Office Reconciliation Automation

Unattended Bots: Automating Reconciliation Tasks

Python’s versatility and simplicity make it an ideal choice for developing unattended bots that can automate repetitive and rule-based reconciliation tasks. These bots can work independently, without human intervention, to compare data, identify discrepancies, and generate reports. By automating these tasks, businesses can significantly reduce the time and effort required for reconciliation, freeing up staff for more value-added activities.

Attended Bots: Enhancing Human Efficiency

Attended bots, also powered by Python, assist human workers in completing reconciliation tasks. These bots can automate specific steps within the reconciliation process, such as data extraction, validation, and matching. By providing real-time assistance, attended bots enhance human efficiency and accuracy, reducing the risk of errors and improving overall productivity.

Cloud Platforms: Orchestrating Automation at Scale

Cloud platforms offer a comprehensive suite of tools and services that enable businesses to orchestrate back-office reconciliation automation at scale. Compared to traditional RPA/workflow tools, cloud platforms provide:

- Enhanced scalability and flexibility

- Advanced data processing and analytics capabilities

- Built-in security and compliance features

AI: Improving Accuracy and Handling Edge Cases

AI techniques, such as image recognition, natural language processing (NLP), and generative AI, can significantly enhance the accuracy and efficiency of back-office reconciliation automation. These techniques can:

- Automate the extraction and interpretation of data from complex documents

- Identify and resolve exceptions and edge cases

- Continuously learn and improve the reconciliation process over time

By leveraging the power of Python, AI, and cloud platforms, businesses in the investment industry can transform their back-office reconciliation processes, unlocking new levels of efficiency, accuracy, and data integrity.

Building Back-Office Reconciliation Automation with Python and Cloud

Step 1: Process Analysis

The first step in automating back-office reconciliation is to thoroughly analyze the processes involved. This includes identifying the data sources, the reconciliation rules, and the exceptions that may arise. Understanding the nuances of the process is crucial for developing an effective automation solution.

Step 2: Data Extraction and Validation

Using Python and cloud services, businesses can automate the extraction and validation of data from various sources. Cloud platforms provide scalable data processing capabilities, while Python offers libraries for parsing and validating data.

Step 3: Reconciliation and Exception Handling

The reconciliation process involves comparing data from different sources and identifying discrepancies. Python’s flexibility allows for the implementation of complex reconciliation rules and exception handling mechanisms. AI techniques can further enhance accuracy by automating the identification and resolution of edge cases.

Step 4: Reporting and Monitoring

Automated back-office reconciliation systems should generate detailed reports that provide insights into the reconciliation process and identify areas for improvement. Cloud platforms offer robust reporting and monitoring tools that enable businesses to track the performance of their automation and make data-driven decisions.

Data Security and Compliance

Data security and compliance are paramount in the investment industry. Python and cloud platforms provide robust security features, such as encryption, access control, and audit trails, to ensure the confidentiality and integrity of sensitive financial data.

Advantages of Python over No-Code RPA/Workflow Tools

- Flexibility and Customization: Python is a general-purpose programming language that offers unparalleled flexibility and customization options. This allows businesses to tailor their back-office reconciliation automation solutions to their specific needs and processes.

- Scalability and Performance: Python, combined with cloud platforms, can handle large volumes of data and complex reconciliation tasks efficiently. This scalability ensures that the automation can adapt to growing business needs.

- Integration with Existing Systems: Python’s open-source nature and extensive library ecosystem make it easy to integrate with existing systems and data sources, simplifying the implementation of back-office reconciliation automation.

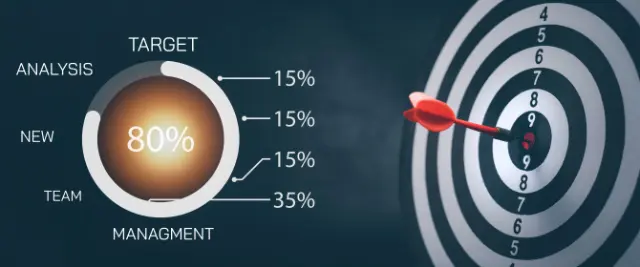

Algorythum’s Approach: Empowering Clients with Python-Based Automation

Algorythum recognizes the limitations of off-the-shelf RPA/workflow tools and takes a different approach. By leveraging Python and cloud platforms, Algorythum empowers clients with:

- Tailor-made Solutions: Custom-built automation solutions that meet the unique requirements of each client’s back-office reconciliation processes.

- Exceptional Performance: High-performance automation systems that can handle complex tasks and large data volumes efficiently.

- Seamless Integration: Automated solutions that seamlessly integrate with existing systems and data sources, minimizing disruption and maximizing value.

The Future of Back-Office Reconciliation Automation

As technology continues to advance, there are exciting possibilities to extend and enhance back-office reconciliation automation solutions. Some potential future directions include:

- Integration with Cognitive Technologies: Leveraging cognitive technologies, such as machine learning and natural language processing, to automate even more complex reconciliation tasks and improve decision-making.

- Real-Time Reconciliation: Implementing real-time reconciliation capabilities to provide up-to-date insights and enable proactive risk management.

- Blockchain Integration: Exploring the use of blockchain technology to enhance data security, transparency, and auditability in back-office reconciliation processes.

Subscribe and Contact Us

Stay ahead of the curve by subscribing to our newsletter for the latest industry-specific automation trends and insights.

For a free feasibility assessment and cost estimate tailored to your specific back-office reconciliation automation requirements, contact our team of experts today.

Together, let’s unlock the full potential of automation and transform your back-office reconciliation processes for greater efficiency, accuracy, and data integrity.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.