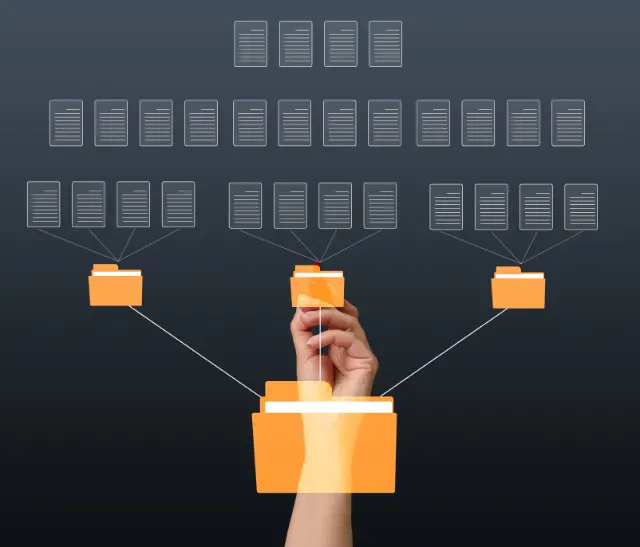

Document Classification and Indexing Automation: A Lifeline for the Insurance Industry

The insurance industry relies heavily on efficient document management systems to process the high volume of applications, claims, and other paperwork they receive daily. Document classification and indexing automation using Python, AI, and cloud-based solutions can streamline this process, saving time, reducing costs, and improving accuracy.

Challenges of Manual Document Processing

- Time-consuming and labor-intensive

- Prone to errors and inconsistencies

- Difficult to organize and retrieve documents efficiently

Benefits of Automation

- Increased efficiency: Automating document classification and indexing can save insurance companies significant time and money.

- Improved accuracy: AI-powered automation can classify and index documents with a high degree of accuracy, reducing errors and ensuring that documents are properly organized and easy to retrieve.

- Enhanced customer service: Automated document processing can help insurance companies provide faster and more efficient service to their customers, as documents can be processed and accessed more quickly.

The Role of Python, AI, and Cloud

Python is a powerful programming language that is well-suited for automating tasks like document classification and indexing. AI algorithms can be used to train models that can identify and classify documents based on their content. Cloud-based solutions provide the scalability and flexibility needed to handle large volumes of documents.

By leveraging the power of Python, AI, and cloud, insurance companies can automate their document classification and indexing processes, leading to significant improvements in efficiency, accuracy, and customer service.

Python, AI, and Cloud: The Power Trio for Document Classification and Indexing Automation

Python, AI, and cloud-based solutions play a pivotal role in document classification and indexing automation, enabling insurance companies to streamline their processes and improve efficiency.

Python: The Automation Engine

Python is a versatile programming language that is ideally suited for developing unattended and attended bots for document classification and indexing automation.

- Unattended bots: These bots can run autonomously, without human intervention, to classify and index large volumes of documents. Python’s powerful libraries and frameworks make it easy to develop robust and efficient bots.

- Attended bots: These bots work alongside human employees, assisting them with tasks such as document classification and indexing. Python’s flexibility allows for a high degree of customization, enabling attended bots to be tailored to specific needs and workflows.

Cloud: The Scalable Orchestrator

Cloud platforms offer a range of features and capabilities that make them superior to traditional RPA/workflow tools orchestrators for document classification and indexing automation.

- Scalability: Cloud platforms can handle large volumes of documents and scale up or down as needed, ensuring that insurance companies can meet fluctuating demand.

- Flexibility: Cloud platforms provide a wide range of services and tools that can be used to build and deploy automation solutions, giving insurance companies the flexibility to customize their solutions to meet their specific needs.

- Cost-effectiveness: Cloud platforms offer a pay-as-you-go pricing model, which can help insurance companies save money on infrastructure and maintenance costs.

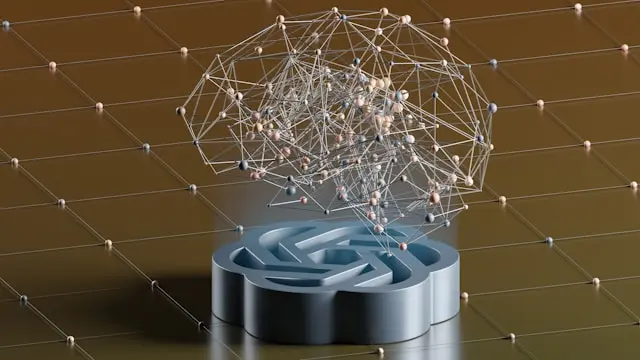

AI: The Accuracy Booster

AI algorithms can significantly improve the accuracy of document classification and indexing automation.

- Image recognition: AI algorithms can be used to identify and extract data from scanned documents, such as applications and claims forms. This can help to reduce errors and improve the efficiency of the automation process.

- Natural language processing (NLP): NLP algorithms can be used to analyze the text content of documents and identify key information, such as policy numbers, customer names, and claim details. This information can then be used to classify and index documents automatically.

- Generative AI: Generative AI techniques, such as GPT-3, can be used to generate document summaries and reports, which can save insurance companies time and effort.

By leveraging the power of Python, AI, and cloud, insurance companies can automate their document classification and indexing processes, leading to significant improvements in efficiency, accuracy, and customer service.

Building the Document Classification and Indexing Automation with Python and Cloud

The process of document classification and indexing automation involves several key steps:

- Data ingestion: Documents are ingested from various sources, such as email, fax, and scanners.

- Document classification: Documents are classified into different categories, such as applications, claims forms, and correspondence.

- Data extraction: Key information is extracted from the documents, such as policy numbers, customer names, and claim details.

- Indexing: Documents are indexed so that they can be easily retrieved and searched.

Automating the Sub-Processes

Python and cloud-based solutions can be used to automate each of these sub-processes:

- Data ingestion: Cloud-based storage services can be used to store documents securely and make them accessible to the automation process.

- Document classification: Python libraries, such as scikit-learn, can be used to train machine learning models that can classify documents with a high degree of accuracy.

- Data extraction: Python libraries, such as PyPDF2 and Beautiful Soup, can be used to extract data from documents.

- Indexing: Cloud-based search services, such as Elasticsearch, can be used to index documents so that they can be quickly and easily retrieved.

Data Security and Compliance

Data security and compliance are critical considerations in the insurance industry. Python and cloud-based solutions provide a number of features that can help insurance companies to protect their data, including:

- Encryption: Documents can be encrypted at rest and in transit to protect them from unauthorized access.

- Authentication and authorization: Cloud-based services provide robust authentication and authorization mechanisms to control access to data.

- Audit trails: Cloud-based services can provide audit trails that track all access to data, making it easier to comply with regulatory requirements.

Advantages of Python and Cloud over No-Code RPA/Workflow Tools

Python and cloud-based solutions offer a number of advantages over no-code RPA/workflow tools for document classification and indexing automation, including:

- Flexibility: Python is a general-purpose programming language that allows for a high degree of customization, making it possible to build automations that are tailored to specific needs.

- Scalability: Cloud-based solutions can scale up or down as needed, ensuring that insurance companies can meet fluctuating demand.

- Cost-effectiveness: Python and cloud-based solutions are often more cost-effective than no-code RPA/workflow tools, especially for large-scale automations.

Algorythum’s Approach

Algorythum takes a different approach to automation because we believe that off-the-shelf automation platforms are often too rigid and inflexible to meet the specific needs of our clients. Our Python-based approach allows us to build custom automations that are tailored to the unique requirements of each client.

We have witnessed firsthand the dissatisfaction of our clients with the performance of off-the-shelf automation platforms. These platforms are often slow, unreliable, and difficult to use. Our Python-based approach overcomes these limitations and provides our clients with the performance, reliability, and ease of use they need to succeed.

The Future of Document Classification and Indexing Automation

The future of document classification and indexing automation is bright. As AI and cloud technologies continue to evolve, we can expect to see even more powerful and efficient automation solutions.

One promising area of research is the use of generative AI to automate the creation of document summaries and reports. This could save insurance companies a significant amount of time and effort.

Another area of research is the use of blockchain technology to secure and track documents. This could help to improve data security and compliance in the insurance industry.

Subscribe and Contact Us

To stay up-to-date on the latest developments in document classification and indexing automation, subscribe to our blog.

If you are interested in learning more about how Algorythum can help you to automate your document classification and indexing processes, contact us today for a free feasibility and cost-estimate.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.