Revolutionizing Loss Ratio Analysis: A Journey Towards Efficiency and Accuracy

The insurance industry has long grappled with the challenges of loss ratio analysis, a critical process that assesses underwriting performance and guides decisions on pricing and risk management. Manual analysis of loss ratios can be arduous, time-consuming, and susceptible to human error, hindering the ability of insurers to make data-driven decisions promptly.

Enter the transformative power of automation! By leveraging the capabilities of Python, artificial intelligence (AI), and cloud-based solutions, insurers can now automate loss ratio analysis, unlocking a world of efficiency, accuracy, and enhanced insights. This intelligent automation streamlines the process, freeing up valuable time for insurance professionals to focus on strategic decision-making.

Keyword Induction:

- Loss Ratio Analysis Automation: Automating loss ratio analysis using cutting-edge technology empowers insurance companies to gain a deeper understanding of their risk profiles and pricing strategies.

- Intelligent Loss Ratio Analysis: Python-based automation, coupled with AI, brings intelligence to loss ratio analysis, providing insurers with actionable insights to optimize underwriting performance.

Python, AI, and the Cloud: A Trio for Loss Ratio Analysis Automation

Python: The Foundation for Unattended and Attended Bots

Python’s versatility shines in loss ratio analysis automation, enabling the development of both unattended and attended bots. Unattended bots, powered by Python, can automate repetitive tasks such as data extraction and analysis, freeing up insurance professionals for more value-added activities.

Attended bots, also built with Python, provide real-time assistance to underwriters during the loss ratio analysis process. These bots can offer guidance, automate calculations, and facilitate decision-making, enhancing productivity and accuracy.

Cloud Platforms: Orchestrating Automation with Power and Flexibility

Cloud platforms transcend the capabilities of traditional RPA/workflow tools, offering a comprehensive suite of features for automation orchestration. Their scalability, elasticity, and integration capabilities make them ideal for handling complex loss ratio analysis processes.

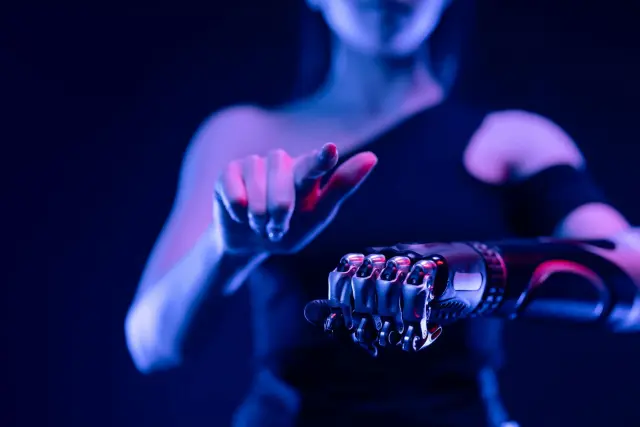

AI: Enhancing Accuracy and Handling Edge Cases

Artificial intelligence (AI) plays a crucial role in improving the accuracy and efficiency of loss ratio analysis automation. AI techniques, such as image recognition, natural language processing (NLP), and generative AI, can:

- Automate data extraction from unstructured documents, such as loss reports and claims files.

- Analyze large volumes of data to identify patterns and trends that may not be apparent to human analysts.

- Handle complex edge cases and exceptions that traditional automation methods may struggle with.

By incorporating AI into loss ratio analysis automation, insurers can gain a deeper understanding of their risk profiles and pricing strategies, leading to more informed decision-making.

Keyword Induction:

- Loss Ratio Analysis Automation: Python, AI, and cloud-based solutions form a powerful trio for automating loss ratio analysis, driving efficiency, accuracy, and enhanced insights for insurers.

- Intelligent Loss Ratio Analysis: AI techniques empower loss ratio analysis automation with the ability to handle complex edge cases and extract valuable insights from unstructured data, making the process more intelligent and comprehensive.

Building the Loss Ratio Analysis Automation with Python and the Cloud

Automating Sub-Processes with Python and Cloud

The loss ratio analysis automation process can be broken down into several sub-processes, each of which can be automated using Python and cloud-based solutions:

- Data Extraction: Python scripts can be developed to extract data from various sources, such as loss reports, claims files, and underwriting systems. Cloud platforms provide scalable storage and computing resources to handle large volumes of data efficiently.

- Data Cleaning and Transformation: Python’s data manipulation libraries can be used to clean and transform the extracted data, ensuring it is in a consistent format for analysis. Cloud platforms offer data pipelines and transformation services to streamline this process.

- Loss Ratio Calculation: Python code can be written to calculate loss ratios based on the cleaned data. Cloud platforms provide elastic compute resources to handle complex calculations efficiently.

- Trend Analysis and Visualization: Python’s data visualization libraries can be used to create interactive dashboards and reports that display loss ratio trends and insights. Cloud platforms offer data visualization services to simplify this process.

Data Security and Compliance in Insurance

Data security and compliance are paramount in the insurance industry. Python and cloud platforms provide robust security measures, including encryption, access controls, and audit trails, to ensure the confidentiality and integrity of sensitive data.

Python vs. No-Code RPA/Workflow Tools

While no-code RPA/workflow tools offer a low-code/no-code approach to automation, they may have limitations in handling complex processes and integrating with diverse systems. Python, on the other hand, provides greater flexibility, customization options, and the ability to integrate with a wide range of data sources and cloud services.

Algorythum’s Approach

Algorythum takes a Python-based approach to loss ratio analysis automation, recognizing the limitations of off-the-shelf RPA platforms. Our approach offers:

- Customization: Python allows us to tailor the automation to meet the specific needs of each insurance client.

- Scalability: Cloud platforms enable us to scale the automation to handle large volumes of data and complex calculations efficiently.

- Integration: Python and cloud platforms seamlessly integrate with insurance systems and data sources, ensuring a comprehensive and automated workflow.

Keyword Induction:

- Loss Ratio Analysis Automation: Python and cloud-based solutions provide a powerful platform for automating loss ratio analysis, offering flexibility, scalability, and security.

- Intelligent Loss Ratio Analysis: By leveraging Python and AI techniques, Algorythum’s loss ratio analysis automation delivers intelligent insights and helps insurers make data-driven decisions.

The Future of Loss Ratio Analysis Automation

The advancements in Python, AI, and cloud computing hold exciting possibilities for enhancing loss ratio analysis automation even further.

- Integration with Advanced Analytics: By incorporating advanced analytics techniques, such as predictive modeling and machine learning, insurers can gain a deeper understanding of risk factors and pricing dynamics.

- Real-Time Loss Ratio Monitoring: Cloud-based streaming platforms can enable real-time monitoring of loss ratios, allowing insurers to respond promptly to changes in risk profiles.

- Automated Risk Management: AI-powered automation can assist insurers in identifying and mitigating risks proactively, leading to improved underwriting performance.

Subscribe and Connect with Algorythum

Stay ahead of the curve in insurance automation by subscribing to our newsletter. Receive exclusive updates on the latest trends, case studies, and best practices in loss ratio analysis automation.

If you’re ready to transform your loss ratio analysis process, contact our team today for a free feasibility assessment and cost estimate. Our experts will work with you to develop a customized automation solution that meets your specific requirements.

Keyword Induction:

- Loss Ratio Analysis Automation: As technology continues to evolve, loss ratio analysis automation will become even more sophisticated and valuable for insurers seeking to optimize their underwriting performance.

- Intelligent Loss Ratio Analysis: Algorythum is at the forefront of loss ratio analysis automation, leveraging cutting-edge technologies to deliver intelligent solutions that empower insurers to make data-driven decisions.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.