Policy Cancellation Automation: Empowering Insurance Providers with Efficiency and Accuracy

In the dynamic and competitive insurance industry, providing exceptional customer service is paramount. Policy cancellation is an inevitable part of the insurance lifecycle, and automating this process can bring immense benefits to both insurance providers and their customers.

Policy Cancellation Automation utilizes the power of Python, AI, and cloud-based solutions to streamline and enhance the cancellation process. By leveraging automation, insurance companies can:

- Enhance Efficiency: Automate repetitive and time-consuming tasks, freeing up resources for more strategic initiatives.

- Improve Accuracy: Eliminate manual errors and ensure consistent handling of cancellations.

- Accelerate Processing: Streamline the cancellation process, reducing turnaround time and improving customer satisfaction.

Embracing Policy Cancellation Automation is a transformative step towards modernizing insurance operations. It empowers providers to deliver a seamless and efficient experience for their policyholders, fostering stronger relationships and driving growth.

Python, AI, and Cloud: The Power Trio for Policy Cancellation Automation

Unattended Bots: Automating Repetitive Tasks

Python’s robust capabilities make it an ideal choice for developing unattended bots that can automate repetitive and time-consuming tasks in the policy cancellation process. These bots can:

- Process cancellation requests 24/7, eliminating the need for manual intervention during off-hours.

- Extract data from various sources, such as policy documents and customer records, to initiate the cancellation process.

- Generate and send cancellation notices to policyholders, ensuring timely communication.

Attended Bots: Enhancing Agent Productivity

Attended bots, also built with Python, can assist insurance agents in handling policy cancellations. These bots can:

- Provide real-time guidance to agents, reducing the risk of errors and improving accuracy.

- Automate data entry and retrieval, freeing up agents to focus on customer interactions.

- Offer personalized recommendations based on customer history and preferences, enhancing the overall customer experience.

Cloud Platforms: Orchestrating Automation at Scale

Cloud platforms offer a comprehensive suite of features and capabilities that far surpass traditional RPA/workflow tools. These platforms provide:

- Scalability: Handle high volumes of cancellation requests without compromising performance.

- Security: Protect sensitive customer data and comply with industry regulations.

- Integration: Seamlessly connect with other insurance systems and applications.

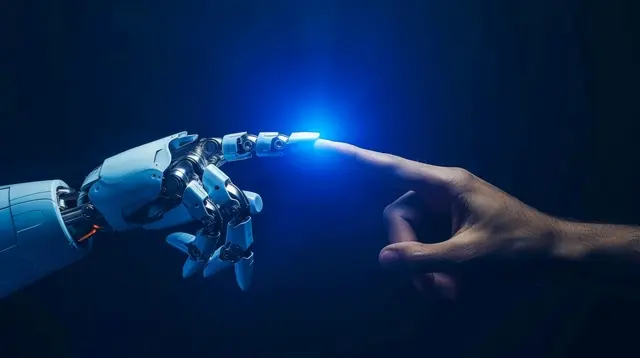

AI: Enhancing Accuracy and Handling Complexity

AI techniques such as image recognition, natural language processing (NLP), and generative AI can significantly improve the accuracy and efficiency of policy cancellation automation. These techniques can:

- Extract data from complex documents, such as cancellation forms, with high precision.

- Understand and respond to customer inquiries in natural language, providing personalized support.

- Identify and handle edge cases that may not be covered by predefined rules, ensuring seamless automation.

By leveraging the power of Python, AI, and cloud platforms, insurance providers can transform their policy cancellation processes, delivering a superior customer experience while driving operational efficiency.

Building the Policy Cancellation Automation with Python and Cloud

Sub-Process Automation

1. Request Initiation:

- Automate the creation of cancellation requests based on customer submissions or internal triggers.

- Use Python to extract data from various sources, such as emails, forms, and CRM systems.

- Integrate with cloud services to store and manage cancellation requests securely.

2. Policy Validation:

- Verify the validity of cancellation requests against policy terms and conditions.

- Use Python to access and analyze policy data stored in cloud databases.

- Implement AI techniques to identify and handle complex scenarios, such as partial cancellations or overlapping policies.

3. Customer Notification:

- Generate and send cancellation notices to policyholders via email, SMS, or other preferred channels.

- Use Python to personalize communication based on customer preferences and language.

- Integrate with cloud-based communication platforms to ensure timely and reliable delivery.

4. Refund Processing:

- Calculate and process refunds based on policy terms and applicable regulations.

- Use Python to integrate with financial systems and payment gateways.

- Leverage cloud platforms to ensure secure and compliant refund transactions.

Data Security and Compliance

Data security and compliance are paramount in the insurance industry. Algorythum’s Python-based approach adheres to strict security protocols and industry regulations, ensuring:

- Encryption of sensitive data at rest and in transit.

- Role-based access controls and audit trails for traceability.

- Compliance with industry standards such as HIPAA and GDPR.

Advantages of Python over No-Code RPA/Workflow Tools

- Customization: Python offers unparalleled flexibility to tailor automations to specific business requirements.

- Scalability: Python-based automations can easily scale to handle high volumes of cancellations.

- Integration: Python seamlessly integrates with a wide range of insurance systems and applications.

- Cost-Effectiveness: Python is open-source and widely adopted, reducing licensing and maintenance costs.

Algorythum’s Differentiated Approach

Algorythum recognizes the limitations of pre-built RPA tools and takes a Python-first approach because:

- Customized Solutions: We tailor automations to meet the unique needs of each insurance provider.

- Performance Optimization: Python-based automations are highly efficient and can handle complex scenarios effectively.

- Future-Proofing: Python is a constantly evolving language, ensuring that automations remain adaptable to changing business requirements.

- Cost Savings: Algorythum’s Python-based approach often results in lower development and maintenance costs compared to proprietary RPA tools.

The Future of Policy Cancellation Automation

The possibilities for extending and enhancing policy cancellation automation are endless. As technology continues to evolve, we can expect to see even more innovative and sophisticated solutions emerge.

Future Technologies

- Blockchain: Blockchain can provide a secure and transparent way to track and manage policy cancellations.

- Robotic Process Automation (RPA): RPA bots can be integrated with policy cancellation automation to handle repetitive and manual tasks.

- Artificial Intelligence (AI): AI-powered chatbots can provide real-time support to customers during the cancellation process.

To stay ahead of the curve and unlock the full potential of policy cancellation automation, we encourage you to:

- Subscribe to our newsletter for the latest industry-specific automation insights.

- Contact our team today to schedule a free feasibility assessment and cost estimate for your custom requirements.

By embracing the future of policy cancellation automation, insurance providers can streamline operations, enhance customer satisfaction, and gain a competitive edge in the digital age.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.