Empowering Investment Committees with Intelligent Automation

Investment committees play a pivotal role in driving investment decisions and shaping the financial landscape. However, managing these committees can be a complex and time-consuming process, often involving manual tasks such as scheduling meetings, creating agendas, and distributing documentation.

Investment Committee Management Automation: A Revolution in Efficiency

Recognizing the challenges faced by investment committees, innovative solutions have emerged to streamline and automate these processes. Python, AI, and cloud-based technologies are transforming the way committees operate, enhancing efficiency and accuracy while freeing up valuable time for strategic decision-making.

Python, AI, and Cloud: The Cornerstones of Investment Committee Management Automation

Python: The Powerhouse of Unattended Bots

Python’s versatility and robust libraries make it an ideal choice for developing unattended bots that can automate repetitive tasks in investment committee management. These bots can be programmed to:

- Schedule meetings and send out invitations

- Automatically create agendas based on predefined templates

- Gather and compile relevant documents from various sources

Attended Bots: Enhancing User Experience

Attended bots provide real-time assistance to committee members during meetings. Built with Python, these bots offer a high level of customization, allowing them to:

- Take notes and generate meeting minutes

- Provide real-time data and insights

- Facilitate seamless collaboration among attendees

Cloud Platforms: Orchestrating Automation at Scale

Cloud platforms offer a comprehensive suite of features and capabilities that surpass traditional RPA/workflow tools. Their scalability and elasticity enable them to handle large volumes of data and complex automation workflows. Additionally, cloud platforms provide:

- Centralized management and monitoring of automations

- Built-in security and compliance features

- Access to advanced AI services

AI: Enhancing Accuracy and Handling Edge Cases

AI techniques such as image recognition, natural language processing (NLP), and generative AI can significantly improve the accuracy and efficiency of investment committee management automation. For example, AI can:

- Extract key data from documents and presentations

- Summarize meeting minutes and identify action items

- Generate personalized insights and recommendations

Building the Investment Committee Management Automation

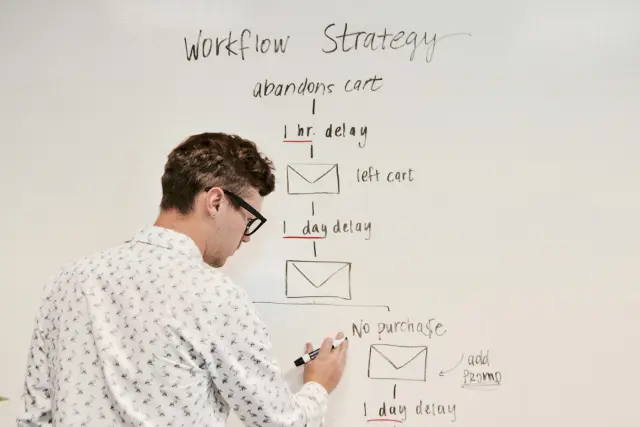

Step-by-Step Automation with Python and Cloud

1. Automating Scheduling

- Use Python to create a scheduling bot that integrates with the committee’s calendar.

- The bot can automatically send out meeting invitations and manage RSVPs.

- Cloud platforms provide centralized management and monitoring of the scheduling process.

2. Agenda Creation

- Develop a Python script that generates agendas based on predefined templates.

- The script can pull data from various sources, such as previous meeting minutes and relevant documents.

- Cloud platforms offer collaboration tools for real-time agenda editing and sharing.

3. Document Distribution

- Automate document distribution using Python and cloud storage services.

- The bot can securely share documents with committee members before and after meetings.

- Cloud platforms provide robust security features to ensure data confidentiality and compliance.

Python vs. No-Code RPA/Workflow Tools

While no-code RPA/workflow tools offer a quick start, they often lack the flexibility and scalability required for complex automation scenarios. Python, on the other hand:

- Provides greater control and customization

- Enables integration with a wide range of cloud services

- Supports advanced AI techniques for enhanced accuracy

Algorythum’s Python-Based Approach

Algorythum recognizes the limitations of off-the-shelf automation platforms and takes a Python-based approach to deliver:

- Tailored solutions that meet specific investment committee requirements

- Scalable automations that can handle growing data volumes and complexity

- Future-proof solutions that leverage the latest AI and cloud advancements

By partnering with Algorythum, investment committees can harness the power of Python and cloud to streamline their operations, improve decision-making, and gain a competitive edge.

The Future of Investment Committee Management Automation

The convergence of Python, AI, and cloud technologies has unlocked a world of possibilities for investment committee management automation. As these technologies continue to evolve, we can expect even more innovative and powerful solutions in the future.

Potential Enhancements

- Predictive Analytics: AI algorithms can analyze historical data and identify patterns to predict future trends and risks, providing valuable insights to investment committees.

- Natural Language Generation: AI-powered bots can automatically generate meeting summaries, reports, and other documents, saving time and improving accuracy.

- Blockchain Integration: Cloud platforms and blockchain technology can be combined to create secure and transparent systems for managing investment committee decisions and records.

Subscribe and Connect

Stay ahead of the curve by subscribing to our newsletter for the latest industry-specific automation updates and insights. Contact our team today for a free feasibility and cost-estimate for your custom investment committee management automation requirements. Together, we can harness the power of technology to transform your investment decision-making processes and drive success.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.