Overcoming the Challenges of Account Balance and Holding Updates Automation with Python, AI, and Cloud

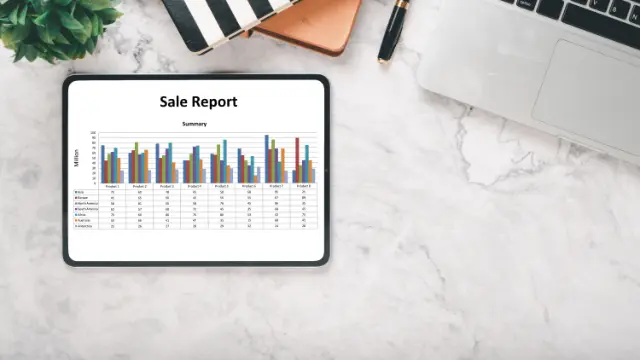

In the fast-paced investment industry, investors rely on timely and accurate access to their account information to make informed decisions. However, manual account balance and holding updates are prone to errors and delays, leading to frustration and potential financial losses.

Account Balance and Holding Updates Automation: A Game-Changer

Automating account balance and holding updates using Python, AI, and cloud-based solutions can revolutionize the investment experience. By streamlining this process, investors can:

- Gain Real-Time Insights: Receive instant notifications of account balance changes and investment holdings, empowering them to stay on top of their financial situation.

- Reduce Errors and Delays: Eliminate manual data entry and reconciliation, ensuring accuracy and efficiency in account updates.

- Enhance Investor Confidence: Provide investors with peace of mind by offering transparent and up-to-date information on their investments.

With the power of automation, investors can now access their financial data in real-time, enabling them to make informed decisions, maximize returns, and navigate the investment landscape with confidence.

Python, AI, and Cloud: The Power Trio for Account Balance and Holding Updates Automation

Python: The Foundation for Unattended and Attended Bots

Python’s versatility and extensive libraries make it the ideal language for developing both unattended and attended bots for account balance and holding updates automation.

Unattended Bots:

Python-based unattended bots can run autonomously, 24/7, to monitor account activity, fetch data from multiple sources, and update account balances and holdings in real-time. This eliminates the need for manual intervention and ensures continuous, error-free updates.

Attended Bots:

Attended bots, built with Python, provide real-time assistance to investors. They can be triggered by specific events, such as a change in account balance or a new investment, and guide investors through the necessary actions. The high level of customization available in Python allows for tailored solutions that meet the unique needs of each investor.

Cloud Platforms: Feature-Rich Orchestrators

Cloud platforms offer a comprehensive suite of features that far surpass traditional RPA/workflow tools orchestrators. They provide:

- Scalability: Cloud platforms can seamlessly scale up or down to meet fluctuating automation demands, ensuring uninterrupted service.

- Reliability: Cloud infrastructure is designed for high availability and redundancy, minimizing downtime and ensuring reliable automation.

- Integration: Cloud platforms offer seamless integration with a wide range of third-party applications and services, enabling end-to-end automation.

AI: Enhancing Accuracy and Handling Edge Cases

AI techniques, such as image recognition, natural language processing (NLP), and generative AI, can significantly enhance the accuracy and capabilities of account balance and holding updates automation.

- Image Recognition: AI can extract data from scanned documents, such as bank statements or investment reports, eliminating the need for manual data entry.

- NLP: AI can interpret unstructured text, such as emails or analyst reports, to identify relevant information and update account holdings accordingly.

- Generative AI: AI can generate synthetic data to handle edge cases or simulate scenarios, improving the robustness and accuracy of the automation process.

By leveraging the power of Python, AI, and cloud platforms, businesses can achieve highly efficient and accurate account balance and holding updates automation, empowering investors with real-time insights into their financial situation.

Building the Account Balance and Holding Updates Automation with Python and Cloud

Step-by-Step Automation Development Process

- Data Extraction: Use Python libraries like BeautifulSoup or Selenium to extract data from web pages, PDFs, or other sources. AI techniques like image recognition and NLP can enhance data extraction accuracy.

- Data Transformation: Convert extracted data into a structured format using Python’s data manipulation libraries (e.g., Pandas, NumPy).

- Data Validation: Implement data validation rules to ensure accuracy and consistency of the extracted data.

- Account Updates: Use Python to update account balances and holdings in the target system (e.g., CRM, ERP). Cloud platforms provide secure and reliable data storage and processing capabilities.

- Notification: Send real-time notifications to investors via email, SMS, or push notifications using Python’s messaging libraries.

Data Security and Compliance

Data security and compliance are paramount in the investment industry. Python and cloud platforms offer robust security features, including encryption, access control, and audit trails. This ensures the confidentiality and integrity of sensitive financial data.

Advantages of Python over No-Code RPA/Workflow Tools

- Flexibility and Customization: Python is a versatile language that allows for highly customized automation solutions tailored to specific business requirements.

- Scalability: Python-based automations can be easily scaled up or down to handle fluctuating data volumes and automation demands.

- Integration: Python seamlessly integrates with a wide range of third-party applications and services, enabling end-to-end automation.

Algorythum’s Approach: Python-Based Automation

Algorythum takes a different approach by leveraging Python and cloud platforms for automation. This is driven by the limitations of off-the-shelf RPA/workflow tools, which often:

- Lack customization and flexibility, limiting the ability to meet specific business needs.

- Have scalability constraints, hindering the automation of large-scale processes.

- Require extensive maintenance and support, increasing the total cost of ownership.

Python-based automation, on the other hand, provides businesses with a robust, scalable, and cost-effective solution for Account Balance and Holding Updates Automation, empowering investors with real-time insights into their financial situation.

The Future of Account Balance and Holding Updates Automation

The future of Account Balance and Holding Updates Automation holds exciting possibilities for further enhancement and innovation.

Integration with AI-Powered Analytics:

AI techniques can be integrated to analyze account data and provide investors with personalized insights and recommendations. For example, AI can identify investment opportunities, predict market trends, and generate tailored financial advice.

Blockchain for Secure and Transparent Data Sharing:

Blockchain technology can be leveraged to create a secure and transparent network for sharing account information among multiple institutions. This would eliminate the need for manual reconciliation and enhance the accuracy and efficiency of updates.

Real-Time Fraud Detection:

AI and machine learning algorithms can be employed to monitor account activity in real-time and detect suspicious transactions. This would provide investors with an additional layer of protection against fraud and unauthorized access.

Subscribe and Contact Us

Stay up-to-date with the latest advancements in Account Balance and Holding Updates Automation by subscribing to our newsletter.

To explore how Algorythum can help you automate your investment processes and gain a competitive edge, contact our team today for a free feasibility assessment and cost estimate tailored to your specific requirements.

Together, let’s unlock the full potential of automation and empower your investors with real-time insights into their financial future.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.