Contribution Scheduling Automation: Empowering Disciplined Investing

In the fast-paced world of investing, consistency is key. Contribution Scheduling Automation emerges as a game-changer, enabling investors to automate recurring contributions effortlessly. By leveraging the power of Python, AI, and cloud-based solutions, this technology streamlines the investment process, promoting disciplined investing habits and paving the way for financial success.

Contribution Scheduling Automation empowers investors to:

- Simplify their investment journey: Remove the hassle of manual contributions and enjoy peace of mind knowing that investments are made on time, every time.

- Stay disciplined: Automate contributions according to investor preferences, ensuring consistent investment behavior and long-term financial goals.

- Maximize returns: By automating contributions, investors can take advantage of compound interest and maximize their returns over time.

Python, AI, and the Cloud: Supercharging Contribution Scheduling Automation

Python, AI, and cloud platforms play pivotal roles in driving the efficiency and accuracy of Contribution Scheduling Automation:

Python: The Powerhouse of Unattended and Attended Bots

Python’s versatility shines in developing both unattended and attended bots for contribution scheduling automation:

- Unattended Bots: Python scripts can automate repetitive tasks such as fetching investor preferences, calculating contribution amounts, and executing trades, freeing up human resources for more strategic activities.

- Attended Bots: Python-based attended bots provide a user-friendly interface, allowing investors to interact with the automation process, providing real-time assistance and customization.

Cloud Platforms: Orchestrating Automation at Scale

Cloud platforms offer a comprehensive suite of features that surpass traditional RPA/workflow tools:

- Scalability: Cloud platforms can effortlessly handle large volumes of transactions, ensuring seamless automation even during peak periods.

- Flexibility: Cloud platforms provide a flexible infrastructure, allowing for easy customization and integration with other systems.

- Security: Cloud platforms prioritize data security, ensuring the confidentiality and integrity of investor information.

AI: Enhancing Accuracy and Handling Edge Cases

AI techniques empower contribution scheduling automation with cognitive capabilities:

- Image Recognition: AI can process scanned documents or images of investor instructions, extracting relevant data for accurate contribution scheduling.

- Natural Language Processing (NLP): NLP enables automation to interpret investor preferences expressed in natural language, reducing errors and improving compliance.

- Generative AI (Gen AI): Gen AI can generate personalized investment recommendations based on investor profiles, enhancing the overall investment strategy.

Building the Contribution Scheduling Automation with Python and Cloud

Automating Sub-Processes with Python and Cloud

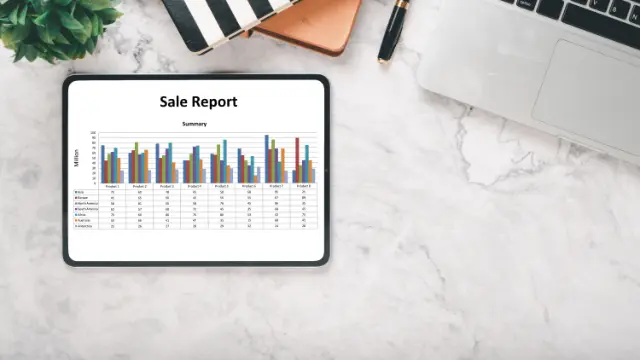

The contribution scheduling automation process can be broken down into the following sub-processes:

- Data Collection: Python scripts can extract investor preferences and account information from various sources, including online forms, emails, or spreadsheets.

- Contribution Calculation: Cloud-based functions can calculate contribution amounts based on investor preferences and market conditions.

- Trade Execution: Python scripts can integrate with trading platforms to execute trades automatically, ensuring timely and accurate investment execution.

Data Security and Compliance

Data security and compliance are paramount in the investment industry. Python and cloud platforms provide robust security measures, including data encryption, access controls, and audit trails, to ensure the confidentiality and integrity of investor information.

Python vs. No-Code RPA/Workflow Tools

While no-code RPA/workflow tools offer a low-code/no-code approach, they often come with limitations:

- Limited Customization: Pre-built RPA tools may not provide the flexibility to handle complex or unique business requirements.

- Scalability Issues: No-code platforms may struggle to handle large volumes of transactions, leading to performance bottlenecks.

- Security Concerns: Some no-code platforms may have security vulnerabilities or lack the necessary compliance certifications.

Python, on the other hand, offers:

- Unmatched Flexibility: Python’s open-source nature allows for complete customization, enabling the development of tailored solutions that meet specific business needs.

- Proven Scalability: Python is known for its scalability and can handle high-volume workloads efficiently.

- Enterprise-Grade Security: Python supports industry-standard security protocols and can be integrated with robust security frameworks.

Algorythum’s Approach: Python-Powered Excellence

Algorythum takes a Python-first approach to contribution scheduling automation, recognizing the limitations of pre-built RPA tools. Our Python-based solutions offer:

- Tailor-made Automations: We develop custom automations that align precisely with your unique business requirements.

- Unmatched Performance: Our Python-powered automations handle large volumes of transactions seamlessly, ensuring uninterrupted operations.

- Enterprise-Grade Security: We prioritize data security and compliance, implementing robust measures to protect investor information.

The Future of Contribution Scheduling Automation: Endless Possibilities

The future of contribution scheduling automation holds exciting possibilities, with emerging technologies poised to further enhance its capabilities:

- Artificial Intelligence (AI): AI techniques can be integrated to provide personalized investment recommendations, optimize contribution strategies, and identify investment opportunities.

- Blockchain: Blockchain technology can be leveraged to create secure and transparent records of investor transactions, reducing the risk of fraud and errors.

- Robotic Process Automation (RPA): RPA bots can be combined with contribution scheduling automation to automate repetitive tasks such as account reconciliation and reporting.

Subscribe and Connect

Stay ahead of the curve by subscribing to our newsletter for the latest industry-specific automation insights and updates.

For a free feasibility analysis and cost estimate tailored to your unique requirements, contact our team today. Together, we can unlock the full potential of contribution scheduling automation and empower your investment journey.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.