Revolutionizing KYC and AML Compliance with Python-Powered Automation

In the fast-paced world of investment, KYC (Know Your Client) and AML (Anti-Money Laundering) compliance are crucial yet time-consuming processes. KYC and AML Compliance Automation streamlines these checks, enhancing efficiency and accuracy.

Python, AI, and cloud-based solutions empower investment firms to automate data extraction, verification, and risk scoring. This agile automation approach reduces manual workload, eliminates human error, and ensures regulatory compliance. Embrace the power of technology to transform your KYC and AML processes today!

Python, AI, and the Cloud: A Trinity for KYC and AML Automation

Python’s versatility extends to developing unattended bots that autonomously execute KYC and AML checks. These bots tirelessly work 24/7, ensuring uninterrupted compliance.

Attended bots, on the other hand, provide real-time assistance to human analysts. Built with Python, they offer a high degree of customization, tailored to specific compliance requirements.

Cloud platforms outshine traditional RPA/workflow tools with their robust features and capabilities. They serve as comprehensive automation orchestrators, managing complex workflows seamlessly.

AI enhances the accuracy of KYC and AML checks by leveraging techniques like image recognition, natural language processing (NLP), and generative AI. These technologies automate document verification, extract data from unstructured sources, and identify potential risks with unmatched precision.

The integration of Python, AI, and the cloud empowers investment firms to streamline their KYC and AML compliance processes, ensuring regulatory adherence, enhancing efficiency, and minimizing operational costs.

Crafting the KYC and AML Automation with Python and the Cloud

The KYC and AML automation journey using Python and the cloud involves several key subprocesses:

- Data Extraction: Python’s web scraping capabilities automate data extraction from various sources, including websites, PDFs, and images. Cloud platforms provide scalable storage and computing power for efficient data processing.

- Data Verification: AI techniques, such as image recognition and NLP, verify extracted data against trusted sources (e.g., government databases). Python scripts leverage these AI models to validate identities, addresses, and other critical information.

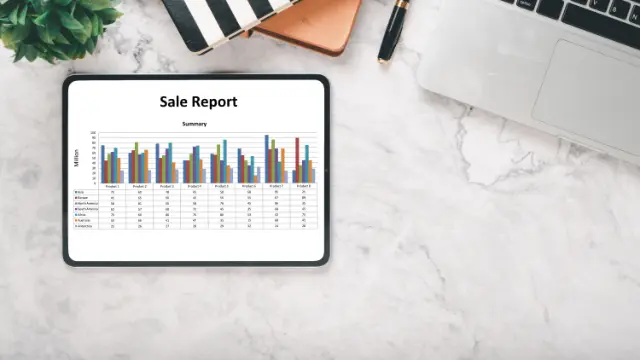

- Risk Scoring: Machine learning algorithms, integrated with Python code, assess risks based on pre-defined criteria. Cloud platforms enable the training and deployment of these models at scale.

Data security and compliance are paramount. Python’s robust encryption libraries and the cloud’s secure infrastructure ensure data protection. Compliance requirements are embedded into the automation framework, reducing the risk of non-compliance.

Compared to no-code RPA/workflow tools, Python-based automation offers:

- Flexibility and Customization: Python’s versatility allows for tailored solutions that cater to specific compliance mandates.

- Scalability and Performance: Cloud platforms provide the scalability and computational power to handle large volumes of data and complex automation processes.

- Cost-Effectiveness: Python is open-source, eliminating licensing costs. Cloud platforms offer flexible pricing models to optimize expenses.

Algorythum’s Python-based approach stems from witnessing clients’ dissatisfaction with the limitations of pre-built RPA tools. Python’s power, combined with our expertise, delivers superior accuracy, efficiency, and compliance for KYC and AML automation.

The Future of KYC and AML Compliance Automation

The convergence of Python, AI, and the cloud unlocks endless possibilities for enhancing KYC and AML compliance automation:

- Blockchain Integration: Blockchain technology can provide a secure and immutable audit trail for compliance records.

- Biometric Authentication: Biometric data, such as facial recognition and voice analysis, can strengthen identity verification.

- Machine Learning-Enhanced Risk Assessment: Machine learning algorithms can continuously learn and adapt to evolving fraud patterns, improving risk scoring accuracy.

Subscribe to our newsletter for the latest industry-specific automation insights and trends.

Contact our team today for a free feasibility and cost estimate for your custom KYC and AML compliance automation requirements. Together, we can revolutionize your compliance processes!

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.