New Account Opening Automation: Empowering Efficiency and Accuracy

In the rapidly evolving investment industry, streamlining new account opening processes is paramount for efficiency and accuracy. New Account Opening Automation leverages the power of Python, AI, and cloud-based solutions to automate data entry, verification, and account setup for new retail investors. By embracing automation, financial institutions can significantly reduce processing time, minimize errors, and enhance the overall onboarding experience.

Challenges of New Account Opening Automation:

- Manual data entry and verification prone to errors

- Lengthy and complex onboarding processes

- Lack of integration between systems

- Compliance and regulatory requirements

Benefits of New Account Opening Automation with Python and AI:

- Improved accuracy and reduced manual errors

- Streamlined and accelerated onboarding process

- Enhanced customer experience and satisfaction

- Reduced operational costs and increased efficiency

- Improved compliance and risk management

Python, AI, and the Cloud: Powering New Account Opening Automation

Python, AI, and cloud platforms play pivotal roles in revolutionizing New Account Opening Automation.

Unattended Bots for Streamlined Automation

Python’s robust capabilities make it ideal for developing unattended bots that can automate repetitive and time-consuming tasks in the new account opening process. These bots can seamlessly handle data entry, verification, and account setup, freeing up human agents to focus on more complex tasks.

Attended Bots for Enhanced User Experience

Attended bots, also built with Python, extend the benefits of automation by assisting human agents in real-time. These bots can provide guidance, automate data entry, and perform other tasks, enhancing the efficiency and accuracy of the onboarding process while improving the user experience.

Cloud Platforms: Orchestrating Automation at Scale

Cloud platforms offer a comprehensive suite of features and capabilities that surpass traditional RPA/workflow tools. They provide a centralized platform for managing and orchestrating automation processes, ensuring seamless integration between systems and applications. The scalability and flexibility of cloud platforms enable organizations to automate complex processes at scale, handling high volumes of new account openings efficiently.

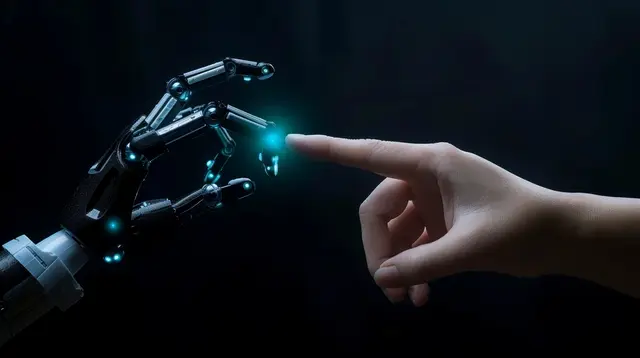

AI for Enhanced Accuracy and Edge Case Handling

AI techniques, such as image recognition, natural language processing (NLP), and generative AI, can significantly enhance the accuracy and capabilities of new account opening automation. AI-powered bots can process unstructured data, handle exceptions, and make intelligent decisions, improving the overall efficiency and accuracy of the onboarding process. For instance, AI can be used to verify identity documents, extract data from handwritten forms, and detect potential fraud, ensuring compliance and reducing risk.

By harnessing the power of Python, AI, and cloud platforms, organizations can achieve unparalleled efficiency and accuracy in their new account opening processes, transforming the onboarding experience for retail investors.

Building the New Account Opening Automation with Python and the Cloud

Sub-Process Automation with Python and Cloud

The New Account Opening Automation process involves several sub-processes that can be automated using Python and cloud platforms:

-

Data Entry Automation: Python scripts can be used to extract data from various sources, such as online forms, scanned documents, and legacy systems. Cloud platforms provide data storage and processing capabilities to handle large volumes of data efficiently.

-

Data Verification Automation: Python’s data validation libraries can be leveraged to verify the accuracy and completeness of data entered by customers. Cloud platforms offer AI-powered services for advanced data validation, such as identity verification and fraud detection.

-

Account Setup Automation: Python scripts can automate the creation of new accounts in the core banking system or other relevant systems. Cloud platforms provide APIs and microservices to seamlessly integrate with various systems and applications.

Data Security and Compliance

Data security and compliance are paramount in the investment industry. Python and cloud platforms offer robust security features to protect sensitive customer data. Encryption, access control, and audit trails ensure the confidentiality, integrity, and availability of data throughout the automation process.

Python vs. No-Code RPA/Workflow Tools

While no-code RPA/workflow tools offer a low-code/no-code approach to automation, they often lack the flexibility and scalability required for complex processes like new account opening. Python, on the other hand, provides greater control and customization, allowing for the development of tailored solutions that meet specific business requirements.

Algorythum’s Approach

Algorythum takes a differentiated approach to automation by leveraging Python and cloud platforms. This approach stems from our experience witnessing client dissatisfaction with the performance and limitations of off-the-shelf automation platforms. Python’s versatility, coupled with the scalability and integration capabilities of cloud platforms, enables us to deliver robust and tailored automation solutions that meet the unique needs of our clients in the investment industry.

The Future of New Account Opening Automation

The New Account Opening Automation solution can be further enhanced by leveraging emerging technologies:

-

Blockchain: Blockchain technology can be integrated to create a secure and transparent ledger for recording account opening transactions, enhancing trust and reducing the risk of fraud.

-

Biometric Authentication: Biometric authentication methods, such as facial recognition and fingerprint scanning, can be incorporated to streamline the identity verification process and improve customer convenience.

-

Conversational AI: Conversational AI chatbots can be deployed to provide real-time assistance to customers during the account opening process, answering queries and resolving issues instantly.

Subscribe to our newsletter to stay updated on the latest automation trends and solutions for the investment industry. Contact our team today to schedule a free feasibility assessment and cost estimate for your custom New Account Opening Automation requirements. Together, we can transform your onboarding process, delivering a seamless and efficient experience for your retail investors.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.