Empowering Advisors: Intelligent Risk Management Alert Automation in Investment

In the fast-paced investment industry, timely risk management is paramount. However, manual alert monitoring and notification processes can be arduous and prone to human error, hindering advisors from making informed decisions swiftly. Risk Management Alert Automation addresses these challenges head-on, enabling advisors to stay ahead of potential risks with precision and efficiency.

Leveraging the power of Python, Artificial Intelligence (AI), and cloud-based solutions, Risk Management Alert Automation streamlines the entire risk management process. It automates alert generation based on pre-defined investment parameters, empowering advisors with real-time visibility into potential portfolio risks. By eliminating manual intervention, this automation ensures accuracy, reduces response time, and allows advisors to focus on strategic decision-making.

Python, AI, and Cloud: The Power Trio for Risk Management Alert Automation

Python for Unattended and Attended Bots

Python’s versatility shines in developing both unattended and attended bots for Risk Management Alert Automation. Unattended bots work autonomously, monitoring market data and generating alerts based on predefined parameters. Attended bots, on the other hand, assist advisors in real-time by providing insights and recommendations during trading sessions. Python’s extensive libraries and ease of integration make it an ideal choice for building tailored bots that meet specific automation needs.

Cloud Platforms: Orchestrating Automation at Scale

Cloud platforms offer a comprehensive suite of services that far surpass the capabilities of traditional RPA/workflow tools. They provide robust infrastructure, elastic scalability, and advanced features like serverless computing and data analytics. By leveraging cloud platforms as automation orchestrators, Risk Management Alert Automation gains the ability to handle complex workflows, process vast amounts of data, and scale effortlessly to meet changing market demands.

AI for Enhanced Accuracy and Edge Case Handling

AI plays a crucial role in enhancing the accuracy and efficiency of Risk Management Alert Automation. Techniques like image recognition and natural language processing (NLP) enable bots to extract insights from unstructured data sources, such as financial news and research reports. Generative AI can generate synthetic data to train models and handle edge cases that may not be covered by predefined rules. By incorporating AI, these automations become more intelligent and adaptive, ensuring that advisors receive timely and accurate risk alerts.

Building the Risk Management Alert Automation with Python and Cloud

Sub-Process Automation with Python and Cloud

-

Data Ingestion and Preprocessing: Python scripts can be used to extract data from various sources, such as market feeds, financial news, and internal databases. Cloud platforms provide scalable data storage and processing capabilities to handle large volumes of data efficiently.

-

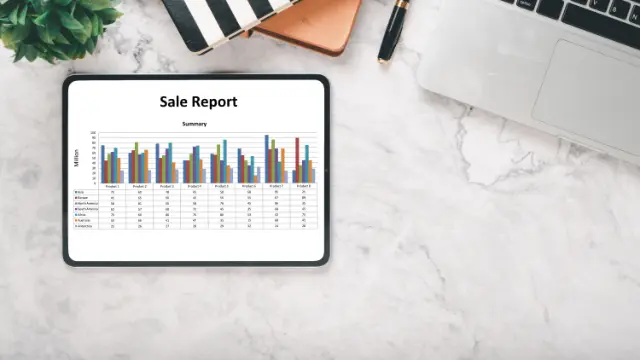

Risk Calculation and Alert Generation: Python-based algorithms can analyze data and calculate risk metrics based on predefined parameters. Cloud functions can be triggered to generate and send alerts in real-time based on these calculations.

-

Advisor Notification and Visualization: Python can be integrated with communication channels to send email or SMS alerts to advisors. Cloud-based dashboards can be created to provide visual representations of risk exposures and trends.

Data Security and Compliance

Data security and compliance are paramount in the investment industry. Python and cloud platforms offer robust security features and encryption capabilities to protect sensitive financial data. Compliance with industry regulations can be ensured through adherence to best practices and regular audits.

Python vs. No-Code RPA/Workflow Tools

Building Risk Management Alert Automation with Python provides several advantages over no-code RPA/Workflow tools:

- Customization and Flexibility: Python allows for tailored automation solutions that can handle complex and evolving investment scenarios.

- Integration with AI and Cloud: Python seamlessly integrates with AI and cloud technologies, enabling advanced data analysis and scalable automation.

- Cost-Effectiveness: Python is open-source and has a large developer community, reducing licensing and maintenance costs.

Algorythum’s Approach: Empowering Clients with Python Expertise

Algorythum recognizes the limitations of off-the-shelf automation platforms. Our Python-based approach empowers clients with:

- Customized Solutions: Tailored Risk Management Alert Automation solutions that meet specific requirements and address unique investment strategies.

- Performance and Scalability: Python’s efficiency and the scalability of cloud platforms ensure fast and reliable automation, even during market volatility.

- Innovation and Future-Proofing: Python’s active development community and Algorythum’s expertise foster continuous innovation and adaptation to evolving industry needs.

The Future of Risk Management Alert Automation

Next-Generation Technologies

As technology continues to advance, we envision the integration of other future technologies to further enhance Risk Management Alert Automation:

- Blockchain: Secure and transparent record-keeping of risk events and alerts.

- Quantum Computing: Accelerated data analysis and risk modeling for complex portfolios.

- 5G and Edge Computing: Real-time risk monitoring and alerts for advisors on the go.

Data Analytics and AI

Advanced data analytics and AI techniques will play a pivotal role in:

- Identifying emerging risks and patterns from vast amounts of data.

- Refining risk models and improving alert accuracy.

- Providing personalized risk insights and recommendations to advisors.

Subscription and Contact Us

Stay ahead of the curve by subscribing to our newsletter for the latest industry-specific automation updates and insights. Contact our team today for a free feasibility and cost-estimate for your custom Risk Management Alert Automation requirements. Let us empower you with tailored solutions that drive efficiency, accuracy, and peace of mind in your investment operations.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.