Simplify Tax Season with Effortless Tax Document Preparation Automation

In the fast-paced world of investments, staying on top of tax obligations can be a daunting task. Tax document preparation, in particular, is often a time-consuming and error-prone process, leaving investors vulnerable to mistakes and missed deadlines. Tax Document Preparation Automation offers a lifeline, enabling investors to automate the generation of tax documents like capital gains reports and tax forms, making tax filing a breeze.

Python, AI, and cloud-based solutions are revolutionizing tax document preparation, streamlining the process for unparalleled efficiency and accuracy. By leveraging these technologies, investors can automate repetitive tasks, minimize errors, and free up valuable time to focus on their core investment strategies.

Python, AI, and Cloud: The Power Trio for Tax Document Preparation Automation

Unattended Bots: Automating the Night Shift

Python’s ability to develop unattended bots is a game-changer for tax document preparation automation. These bots can tirelessly work through the night, processing large volumes of data and generating tax documents without human intervention. By automating repetitive and time-consuming tasks, unattended bots free up valuable time for tax professionals to focus on more complex and strategic work.

Attended Bots: Personalized Automation at Your Fingertips

Attended bots offer a more interactive approach to tax document preparation automation. Built with Python, these bots can assist tax professionals in real-time, providing guidance and automating tasks as needed. The high level of customization available in Python allows attended bots to be tailored to specific workflows and preferences, ensuring a seamless and personalized automation experience.

Cloud Platforms: Supercharging Automation Orchestration

Cloud platforms take tax document preparation automation to new heights. Compared to traditional RPA/workflow tools orchestrators, cloud platforms offer a wider range of features and unparalleled scalability. They provide a centralized platform for managing and executing automation tasks, enabling seamless integration with other business systems and applications.

AI: Enhancing Accuracy and Handling Edge Cases

AI plays a pivotal role in improving the accuracy and efficiency of tax document preparation automation. Techniques like image recognition can automate the extraction of data from scanned documents, eliminating the risk of manual errors. Natural language processing (NLP) can analyze complex tax forms and identify relevant information, ensuring that tax documents are complete and compliant. Generative AI can even generate draft tax documents based on structured data, saving tax professionals even more time.

By harnessing the combined power of Python, AI, and cloud platforms, tax document preparation automation becomes a reality, empowering investors and tax professionals alike. It’s a revolution that simplifies tax season, improves accuracy, and frees up valuable time for more strategic pursuits.

Building the Tax Document Preparation Automation

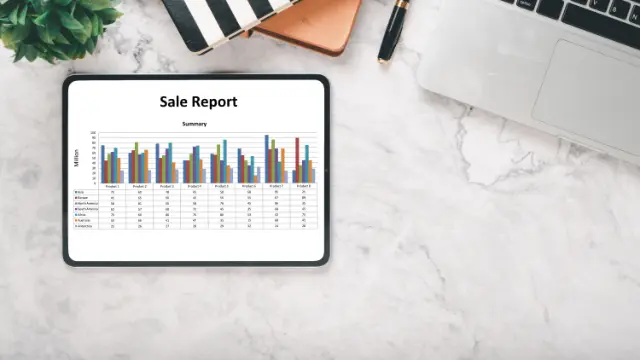

Step 1: Process Analysis and Data Gathering

The first step involves analyzing the existing tax document preparation process to identify the tasks that can be automated. This includes gathering data from various sources such as tax forms, spreadsheets, and databases.

Step 2: Python Script Development

Using Python, developers can create scripts that automate the identified tasks. These scripts can perform data extraction, calculations, and document generation. Python’s extensive libraries for data manipulation and document automation make it an ideal choice for this task.

Step 3: Cloud Integration

Cloud platforms provide a scalable and secure environment for deploying and executing the Python scripts. By leveraging cloud services, businesses can ensure high availability and reliability of their tax document preparation automation.

Step 4: Data Security and Compliance

Data security and compliance are paramount in the investment industry. Python scripts can be integrated with cloud-based security measures to protect sensitive financial data. Additionally, Python’s strong typing and error handling capabilities help ensure the accuracy and integrity of the automated processes.

Advantages of Python over No-Code RPA/Workflow Tools

- Customization: Python offers unparalleled flexibility and customization, allowing developers to tailor the automation to specific requirements.

- Scalability: Python scripts can be easily scaled to handle large volumes of data and complex processes.

- Integration: Python integrates seamlessly with various cloud platforms and other business systems.

Algorythum’s Approach: Empowering Clients with Python

Algorythum recognizes the limitations of off-the-shelf automation platforms and takes a different approach. By leveraging Python and cloud technologies, we deliver tailored tax document preparation automation solutions that:

- Meet the unique requirements of our clients

- Provide superior performance and scalability

- Ensure data security and compliance

Our focus on Python empowers clients with a robust and customizable automation solution that meets their evolving needs.

The Future of Tax Document Preparation Automation

The future of tax document preparation automation is brimming with possibilities. As technology continues to advance, we can expect to see even more innovative and efficient solutions emerge.

One potential area of growth is the integration of artificial intelligence (AI) and machine learning (ML) into tax document preparation automation. AI and ML algorithms can be trained to identify patterns and make decisions, further automating the process and improving accuracy.

Another exciting possibility is the use of blockchain technology to enhance the security and transparency of tax document preparation automation. Blockchain can provide a secure and tamper-proof record of all transactions, giving investors and tax authorities confidence in the integrity of the process.

To stay abreast of the latest advancements in tax document preparation automation, we encourage you to subscribe to our newsletter. You’ll receive regular updates on industry-specific automation trends and best practices.

If you’re considering implementing tax document preparation automation for your investment firm, we invite you to contact our team. We offer free feasibility assessments and cost estimates, so you can make an informed decision about the best solution for your needs.

By embracing the future of tax document preparation automation, you can streamline your processes, improve accuracy, and gain a competitive edge in the investment industry.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.