Embracing Automation for Seamless Client Onboarding and KYC/AML Compliance

In the fast-paced investment industry, streamlining client onboarding and KYC/AML processes is paramount for efficiency and accuracy. Traditional manual methods are often time-consuming, prone to errors, and can delay account activation. Client Onboarding and KYC and AML Automation using Python, AI, and cloud-based solutions offers a transformative solution, empowering businesses to:

- Expedite Account Activation: Automate data collection, document verification, and KYC/AML checks, significantly reducing onboarding time.

- Enhance Accuracy: Leverage AI-powered algorithms to minimize errors and ensure compliance with regulatory requirements.

- Improve Customer Experience: Provide a seamless and intuitive onboarding experience for clients, fostering trust and satisfaction.

Unleashing the Power of Python, AI, and Cloud for Client Onboarding and KYC/AML Automation

Python, AI, and cloud-based solutions form a potent trifecta for automating client onboarding and KYC/AML processes. Here’s how each component contributes:

Python-Powered Unattended Bots:

Python excels in developing unattended bots that can autonomously execute repetitive tasks, freeing up human resources for more complex responsibilities. These bots can handle data extraction, document verification, and KYC/AML checks, ensuring accuracy and efficiency.

Attended Bots for Enhanced User Experience:

Attended bots seamlessly assist human agents during onboarding, providing real-time guidance and automating routine tasks. Built with Python, these bots offer a high degree of customization, empowering businesses to tailor the onboarding experience to their specific needs.

Cloud Platforms: A Superior Orchestration Hub:

Cloud platforms surpass traditional RPA/workflow tools in their orchestration capabilities. They offer a comprehensive suite of features, including:

- Scalability: Dynamically adjust automation resources based on demand, ensuring uninterrupted onboarding processes.

- Security: Implement robust security measures to protect sensitive client data and comply with regulatory requirements.

- Integration: Seamlessly integrate with existing systems, such as CRM and document management solutions, for a cohesive automation ecosystem.

AI for Enhanced Accuracy and Edge Case Handling:

AI algorithms elevate the accuracy and efficiency of onboarding automations. Techniques like image recognition, natural language processing (NLP), and Generative AI (Gen AI) empower bots to:

- Detect and Extract Data: Accurately extract data from various document formats, including scanned images and handwritten forms.

- Verify Documents: Authenticate the validity of identity documents, such as passports and driver’s licenses, using facial recognition and document analysis.

- Identify and Handle Edge Cases: Intelligently handle complex or unusual scenarios, ensuring compliance and minimizing manual intervention.

Architecting a Robust Client Onboarding and KYC/AML Automation Solution

Automating client onboarding and KYC/AML processes involves several key subprocesses:

1. Data Collection:

- Utilize Python’s data extraction libraries to parse data from various document formats, including scanned images and handwritten forms.

- Integrate with cloud-based storage services to securely store and manage collected data.

2. Document Verification:

- Employ AI-powered image recognition algorithms to authenticate identity documents.

- Leverage cloud-based document analysis services to verify document authenticity and extract key information.

3. KYC/AML Checks:

- Implement Python scripts to connect to external KYC/AML databases and perform real-time checks against global watchlists.

- Utilize cloud-based compliance platforms to automate risk assessment and reporting.

Data Security and Compliance:

- Encrypt sensitive data at rest and in transit using industry-standard protocols.

- Implement role-based access controls and audit trails to ensure data security and compliance with regulatory requirements.

Python vs. No-Code RPA/Workflow Tools:

Python offers several advantages over no-code RPA/Workflow tools for building client onboarding and KYC/AML automations:

- Flexibility and Customization: Python provides unparalleled flexibility and customization options, allowing businesses to tailor the automation to their specific needs.

- Scalability and Performance: Python scripts can be easily scaled to handle high volumes of onboarding requests, ensuring seamless performance.

- Integration and Extensibility: Python seamlessly integrates with various cloud platforms, databases, and third-party services, enabling end-to-end automation.

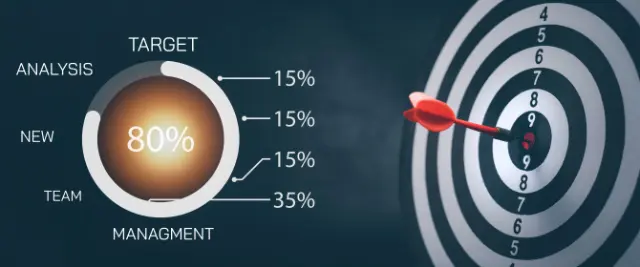

Algorythum’s Approach to Client Onboarding and KYC/AML Automation:

Algorythum takes a Python-first approach to client onboarding and KYC/AML automation, recognizing the limitations of off-the-shelf RPA tools. Our solutions are tailored to each client’s unique requirements, ensuring:

- Optimal Performance: Python-based automations deliver superior performance and scalability, handling complex onboarding processes with ease.

- Enhanced Accuracy: AI-powered algorithms minimize errors and ensure compliance with regulatory requirements.

- Seamless Integration: Our automations seamlessly integrate with existing systems and cloud platforms, creating a cohesive automation ecosystem.

Embracing the Future of Client Onboarding and KYC/AML Automation

The future of client onboarding and KYC/AML automation holds exciting possibilities for further enhancing the proposed solution:

- Blockchain Integration: Leverage blockchain technology to create a secure and transparent audit trail for onboarding and KYC/AML processes.

- Biometric Authentication: Implement biometric authentication methods, such as facial recognition and fingerprint scanning, to enhance security and improve user experience.

- AI-Powered Risk Assessment: Utilize advanced AI algorithms to assess risk levels more accurately and dynamically, reducing the need for manual intervention.

Subscribe to Our Blog for Industry-Specific Automation Insights

Stay up-to-date with the latest trends and advancements in client onboarding and KYC/AML automation by subscribing to our blog.

Contact Us for a Free Feasibility Assessment and Cost Estimate

Let our team of experts assess your unique requirements and provide a comprehensive feasibility assessment and cost estimate for a custom client onboarding and KYC/AML automation solution tailored to your business.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.