Embrace Efficiency: Corporate Action Processing Automation for the Investment Industry

Corporate action processing is a crucial yet complex task in the investment industry, involving the handling of events such as stock splits, dividends, and mergers. Manual processing of these actions is prone to errors, delays, and inefficiencies. Corporate Action Processing Automation using Python, AI, and cloud-based solutions offers a game-changing solution to these challenges.

This innovative approach automates the entire process, from data extraction and analysis to portfolio adjustments and client communication. By streamlining these tasks, firms can enhance operational efficiency, minimize errors, and ensure timely execution of corporate actions.

Python, with its powerful data manipulation and automation capabilities, plays a central role in Corporate Action Processing Automation. AI algorithms analyze vast amounts of data to identify and classify corporate actions, while cloud-based solutions provide the scalability and flexibility needed to handle complex workflows.

Corporate Action Processing Automation is revolutionizing the investment industry, enabling firms to:

- Improve operational efficiency and reduce costs

- Enhance accuracy and mitigate risks

- Respond quickly to corporate actions and minimize impact on clients

- Gain a competitive edge through innovative technology adoption

Embrace the future of Corporate Action Processing Automation and unlock the potential for increased efficiency, accuracy, and growth in the investment industry.

Python, AI, and Cloud: Orchestrating Corporate Action Processing Automation

Python, AI, and cloud technologies form a powerful triumvirate for Corporate Action Processing Automation. Here’s how each component contributes:

Python: The Automation Workhorse

Python’s versatility and automation capabilities make it ideal for developing unattended bots that can handle repetitive, high-volume tasks in corporate action processing. These bots can be programmed to:

- Extract data from various sources, including emails, PDFs, and spreadsheets

- Classify corporate actions based on pre-defined rules

- Update portfolio positions and generate client communications

Attended Bots: Empowering Human-Machine Collaboration

Attended bots assist human users in completing tasks, providing real-time guidance and support. In corporate action processing, attended bots can:

- Provide context-sensitive help to users

- Automate data entry and validation tasks

- Offer suggestions and recommendations based on historical data

Cloud Platforms: The Orchestration Hub

Cloud platforms offer a comprehensive suite of automation capabilities that surpass traditional RPA/workflow tools. They provide:

- Scalability and elasticity to handle fluctuating workloads

- Centralized management and monitoring of automation processes

- Integration with diverse applications and data sources

AI: Enhancing Accuracy and Handling Complexity

AI techniques, such as image recognition, natural language processing (NLP), and Generative AI, further enhance the capabilities of Corporate Action Processing Automation:

- Image recognition can extract data from complex documents, such as scanned images of corporate action announcements.

- NLP can analyze unstructured text, such as emails and meeting transcripts, to identify relevant information.

- Generative AI can generate tailored client communications and responses to inquiries.

By leveraging the combined power of Python, AI, and cloud, investment firms can create robust, scalable, and intelligent automation solutions that streamline corporate action processing, improve operational efficiency, and enhance client satisfaction.

Building the Corporate Action Processing Automation with Python and Cloud

Automation Development Process

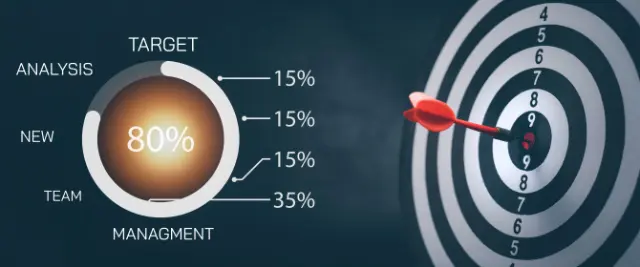

The Corporate Action Processing Automation development process using Python and cloud involves the following steps:

- Process Analysis: Identify and document the sub-processes involved in corporate action processing, such as data extraction, classification, portfolio adjustment, and client communication.

- Bot Development: Develop Python scripts or bots to automate each sub-process. Utilize cloud platforms to orchestrate and manage the bots.

- Data Integration: Integrate the automation solution with relevant data sources and applications, such as portfolio management systems and client communication channels.

- Testing and Deployment: Thoroughly test the automation solution to ensure accuracy and reliability. Deploy the solution to the cloud platform for scalability and accessibility.

Data Security and Compliance in Investment

Data security and compliance are paramount in the investment industry. Python-based automation solutions offer robust security features, such as:

- Encryption of sensitive data

- Role-based access controls

- Audit trails and logging

These measures ensure that data is protected from unauthorized access and manipulation, meeting regulatory requirements and industry best practices.

Python vs. No-Code RPA/Workflow Tools

Python offers several advantages over no-code RPA/workflow tools for Corporate Action Processing Automation:

- Flexibility and Customization: Python allows for the development of highly customized automation solutions tailored to specific business requirements.

- Scalability and Performance: Python scripts can be easily scaled to handle large volumes of data and complex workflows, ensuring efficient processing.

- Integration and Extensibility: Python seamlessly integrates with diverse applications and data sources, enabling the automation of end-to-end processes.

Algorythum’s Approach

Algorythum takes a Python-based approach to Corporate Action Processing Automation because we recognize the limitations of off-the-shelf automation platforms. These platforms often:

- Lack Customization: Pre-built solutions may not fully align with unique business requirements, limiting flexibility and efficiency.

- Limited Scalability: Off-the-shelf tools may struggle to handle complex and high-volume workflows, leading to performance bottlenecks.

- Data Security Concerns: Some platforms may not provide adequate data security measures, increasing the risk of data breaches and compliance issues.

Our Python-based solutions address these challenges, delivering tailored, scalable, and secure automation solutions that empower investment firms to streamline corporate action processing and achieve operational excellence.

The Future of Corporate Action Processing Automation

The future of Corporate Action Processing Automation is bright, with emerging technologies promising even greater efficiency, accuracy, and insights. Here are a few potential possibilities:

- Cognitive Automation: Integration of cognitive technologies, such as natural language processing and machine learning, to enhance automation capabilities.

- Real-Time Processing: Leveraging streaming data technologies to enable real-time processing of corporate actions, ensuring prompt portfolio adjustments.

- Predictive Analytics: Utilizing AI to predict the impact of corporate actions on portfolios, informing investment decisions.

Subscribe and Connect

To stay updated on the latest advancements in Corporate Action Processing Automation and other industry-specific automation solutions, subscribe to our newsletter.

Contact our team today for a free feasibility assessment and cost estimate for your custom automation requirements. Let us help you harness the power of Python, AI, and cloud to streamline your corporate action processing and achieve operational excellence.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.