Humanizing Margin Call Processing: Enhancing Efficiency and Mitigating Risk

Margin calls can be a stressful experience for investment firms, triggering a cascade of time-sensitive actions that require precision and speed. Margin Call Processing Automation offers a lifeline, streamlining the entire process and empowering firms to respond swiftly and effectively.

By leveraging the power of Python, AI, and cloud-based solutions, we can automate critical aspects of margin call processing, from real-time monitoring and notifications to accurate calculations and timely collections. This technological symphony not only enhances efficiency but also minimizes the risk of human error, ensuring accuracy and compliance.

Python, AI, and Cloud: The Trifecta for Margin Call Processing Automation

Unveiling the Power of Python

Python’s versatility shines in Margin Call Processing Automation, enabling the creation of unattended bots that tirelessly monitor market fluctuations and trigger notifications when margins fall below predefined thresholds. These bots operate autonomously, freeing up valuable human resources for more strategic tasks.

Attended Bots: A Symbiotic Collaboration

Attended bots, built with Python’s robust capabilities, seamlessly integrate with existing systems, providing real-time assistance to human operators. They can automate repetitive tasks, such as data entry and calculations, while allowing human oversight for critical decision-making.

Cloud Platforms: The Ultimate Orchestrator

Cloud platforms offer a comprehensive suite of features that far surpass traditional RPA/workflow tools. They provide scalable infrastructure, advanced security measures, and powerful automation capabilities, making them ideal orchestrators for complex margin call processing workflows.

AI: Enhancing Precision and Handling Edge Cases

AI plays a crucial role in Margin Call Processing Automation, improving accuracy and handling edge cases. Techniques like image recognition can automate document processing, while natural language processing (NLP) can extract insights from unstructured data. Generative AI can even generate tailored responses to specific margin call scenarios.

By harnessing the combined power of Python, AI, and cloud platforms, we can transform margin call processing into a streamlined, efficient, and risk-averse operation, empowering investment firms to navigate market volatility with confidence.

Building the Margin Call Processing Automation Engine

Step 1: Process Analysis and Decomposition

We begin by meticulously analyzing the margin call processing workflow, breaking it down into individual sub-processes. Each sub-process is then carefully mapped out, identifying the data inputs, outputs, and decision points.

Step 2: Python Script Development

Using Python’s powerful scripting capabilities, we develop custom scripts to automate each sub-process. These scripts leverage cloud-based infrastructure for scalability and reliability.

Step 3: Integration and Orchestration

We integrate the individual scripts into a cohesive automation workflow, orchestrating their execution using a cloud-based platform. This ensures seamless data flow and efficient task management.

Step 4: Data Security and Compliance

Data security and compliance are paramount in the investment industry. Our automation solution adheres to strict regulatory requirements, ensuring the confidentiality and integrity of sensitive financial data.

Python vs. No-Code RPA/Workflow Tools

While no-code tools offer a low-entry barrier, they often lack the flexibility and customization capabilities of Python. Python’s open-source nature allows for tailored solutions that meet the unique requirements of margin call processing.

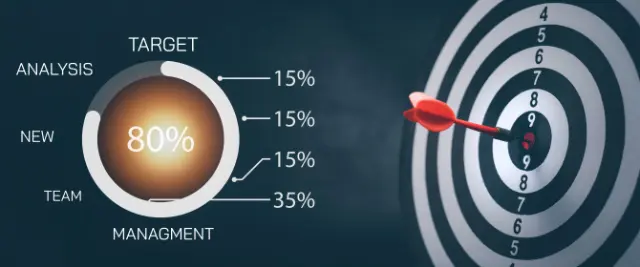

Algorythum’s Differentiator

Algorythum recognizes the limitations of off-the-shelf automation platforms. Our Python-based approach empowers clients to:

- Customize automations to their specific business processes

- Integrate with legacy systems and complex data sources

- Leverage advanced AI techniques for enhanced accuracy and efficiency

- Ensure compliance with industry regulations and data security standards

By choosing Algorythum, clients gain a robust and scalable Margin Call Processing Automation solution that drives efficiency, mitigates risk, and empowers them to make informed decisions in a rapidly evolving market landscape.

The Future of Margin Call Processing Automation

The convergence of cutting-edge technologies holds immense potential to further enhance Margin Call Processing Automation. Here are some exciting possibilities:

- Blockchain Integration: Leveraging blockchain technology can create a secure and transparent record of margin call transactions, streamlining the reconciliation process and fostering trust among counterparties.

- Real-Time Risk Monitoring: Advanced AI algorithms can analyze market data in real-time, identifying potential margin call triggers and enabling proactive risk management strategies.

- Cognitive Automation: Natural language processing (NLP) and machine learning (ML) can automate complex decision-making processes, such as assessing collateral eligibility and determining appropriate margin call actions.

Subscribe to Our Insights

Stay ahead of the curve by subscribing to our newsletter. We regularly share industry-specific automation insights and best practices to empower your investment operations.

Contact Us for a Free Feasibility Assessment

Unlock the full potential of Margin Call Processing Automation for your firm. Contact our team today for a free feasibility assessment and cost estimate tailored to your specific requirements. Together, we can transform your margin call processes, driving efficiency, mitigating risk, and positioning your firm for success in the dynamic investment landscape.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.