Empowering Investment Professionals with Intelligent Market Data Monitoring Automation

Market data monitoring is a critical yet challenging aspect of investment management. The sheer volume and complexity of real-time market data can overwhelm analysts, leading to missed opportunities and suboptimal decision-making. Market Data Monitoring Automation addresses this challenge by leveraging the power of Python, AI, and cloud-based solutions to streamline and enhance the data analysis process. This innovative approach empowers investment professionals to make informed decisions with greater efficiency and accuracy, maximizing their potential for success in the dynamic investment landscape.

Python, AI, and Cloud: The Cornerstones of Market Data Monitoring Automation

Python, AI, and cloud-based solutions play a pivotal role in Market Data Monitoring Automation:

Python for Unattended and Attended Bots:

Python excels in developing both unattended and attended bots. Unattended bots can autonomously monitor market data, identify trading opportunities, and execute trades without human intervention. Attended bots, on the other hand, provide real-time assistance to analysts, offering insights and recommendations based on the latest market data. Python’s flexibility and ease of integration make it an ideal choice for building sophisticated bots that can adapt to changing market conditions.

Cloud Platforms: Orchestrating Automation at Scale

Cloud platforms offer a comprehensive suite of features and capabilities that far surpass traditional RPA/workflow tools. They provide scalable infrastructure, robust security, and access to advanced analytics and AI services. By leveraging cloud platforms, businesses can orchestrate complex automation workflows that involve multiple applications, data sources, and AI models.

AI for Enhanced Accuracy and Edge Case Handling

AI techniques such as image recognition, natural language processing (NLP), and generative AI can significantly enhance the accuracy and effectiveness of Market Data Monitoring Automation. Image recognition can analyze charts and graphs to identify patterns and trends. NLP can extract insights from unstructured market news and reports. Generative AI can generate synthetic market data for testing and validation purposes. By incorporating AI into automation workflows, businesses can improve decision-making and mitigate risks.

Building the Market Data Monitoring Automation with Python and Cloud

The Market Data Monitoring Automation process using Python and cloud can be broken down into the following steps:

- Data Extraction: Extract real-time market data from various sources using Python libraries and cloud APIs.

- Data Analysis: Analyze the extracted data using Python’s data manipulation and visualization libraries. Identify trends, patterns, and trading opportunities.

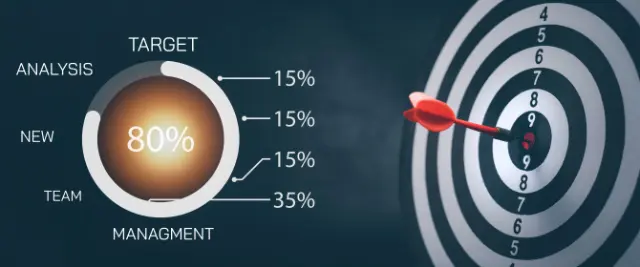

- Decision-Making: Leverage AI models and cloud-based analytics services to make informed trading decisions.

- Trade Execution: Execute trades automatically using Python-based bots or cloud-based trading platforms.

Data Security and Compliance:

Data security and compliance are paramount in the investment industry. Python and cloud platforms offer robust security features to protect sensitive market data and ensure compliance with regulatory requirements.

Python vs. No-Code RPA/Workflow Tools:

Python provides greater flexibility, scalability, and customization compared to no-code RPA/workflow tools. It allows for building sophisticated automations that can handle complex market data analysis and decision-making. No-code tools, while easier to use, often lack the power and flexibility required for advanced Market Data Monitoring Automation.

Algorythum’s Approach:

Algorythum takes a different approach from most BPA companies due to the limitations of off-the-shelf automation platforms. Our Python-based approach offers:

- Customization: Tailor automations to meet specific investment strategies and requirements.

- Scalability: Handle large volumes of market data and complex workflows effectively.

- Integration: Seamlessly integrate with existing systems and data sources.

- Innovation: Leverage the latest advancements in Python and AI to drive automation innovation.

The Future of Market Data Monitoring Automation

The future of Market Data Monitoring Automation holds exciting possibilities:

- Real-Time AI-Powered Insights: AI will play an even greater role in analyzing market data, providing real-time insights and predictive analytics to help investors make more informed decisions.

- Edge Computing for Low-Latency Trading: Edge computing will bring automation closer to the data source, enabling low-latency trading and faster decision-making.

- Quantum Computing for Complex Analysis: Quantum computing could revolutionize market data analysis by enabling the processing of massive datasets and complex algorithms in real-time.

Subscribe and Contact Us:

Stay ahead of the curve by subscribing to our newsletter for the latest industry-specific automation updates. Contact our team today for a free feasibility and cost-estimate for your custom Market Data Monitoring Automation requirements. Let us help you unlock the full potential of your investment data and empower your decision-making.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.