Revolutionizing Order Entry and Management with Intelligent Automation

Introduction

In the fast-paced and competitive world of investment, efficiency and accuracy are paramount. Order entry and management processes play a crucial role in driving success, but they often face challenges that hinder optimal performance. Order Entry and Management Automation emerges as a solution to these challenges, leveraging the power of Python, AI, and cloud-based technologies to streamline operations, minimize errors, and expedite trade lifecycles.

Challenges of Order Entry and Management

- Manual Processes: Traditional order entry and management processes rely heavily on manual intervention, leading to potential errors and delays.

- Complex Workflow: The processing of orders involves multiple steps and stakeholders, creating a complex workflow that can be prone to inefficiencies.

- Data Inconsistency: Manual data entry can introduce inconsistencies, affecting the accuracy of trade executions and settlements.

Intelligent Order Entry and Management Automation

Order Entry and Management Automation addresses these challenges by automating various aspects of the process, including:

- Order Intake: Python scripts can be used to automate order intake, capturing data from multiple sources and performing initial validations.

- Order Validation: AI-powered algorithms analyze incoming orders, checking for errors, inconsistencies, and compliance with regulatory requirements.

- Execution: Automated systems can execute orders across multiple asset classes, ensuring timely and efficient trade executions.

- Order Management: Cloud-based solutions provide a centralized platform for tracking, managing, and monitoring orders throughout their lifecycle.

Benefits of Order Entry and Management Automation

- Reduced Errors: Automation eliminates human errors, ensuring accurate and consistent order processing.

- Increased Efficiency: Streamlined workflows accelerate trade lifecycles, leading to faster execution and settlement.

- Enhanced Compliance: Automated validation processes ensure compliance with regulatory requirements and industry best practices.

- Cost Savings: Automation reduces manual labor costs and eliminates the need for error-prone processes.

- Improved Client Satisfaction: Efficient and accurate order processing leads to improved client satisfaction and loyalty.

Conclusion

Order Entry and Management Automation is transforming the investment industry by revolutionizing the way orders are processed and managed. By leveraging Python, AI, and cloud-based solutions, firms can streamline operations, minimize errors, and gain a competitive edge in the dynamic financial markets.

Python, AI, and Cloud: The Cornerstones of Order Entry and Management Automation

Python and Bots for Automation

Python, a versatile programming language, plays a crucial role in developing both unattended and attended bots for Order Entry and Management Automation.

- Unattended Bots: Python scripts can be used to create unattended bots that automate repetitive tasks, such as order intake, data validation, and trade execution. These bots can operate 24/7, ensuring uninterrupted processing and reducing the risk of errors.

- Attended Bots: Attended bots provide assistance to human operators, enhancing their productivity and accuracy. Built with Python, attended bots can be customized to meet specific requirements, providing real-time support during order entry and management processes.

Cloud Platforms as Orchestrators

Cloud platforms offer a comprehensive suite of features and capabilities that make them superior to traditional RPA/workflow tools for automation orchestration. These platforms provide:

- Scalability: Cloud platforms can seamlessly scale to meet fluctuating demands, ensuring uninterrupted automation processes.

- Reliability: Cloud-based solutions offer high availability and redundancy, minimizing downtime and ensuring continuous operations.

- Integration: Cloud platforms integrate with a wide range of applications and services, enabling seamless data exchange and process orchestration.

AI for Enhanced Accuracy and Efficiency

AI plays a vital role in improving the accuracy and efficiency of Order Entry and Management Automation. AI techniques such as:

- Image Recognition: AI algorithms can analyze images of trade orders, extracting data and identifying potential errors.

- Natural Language Processing (NLP): NLP models can process unstructured text data, such as emails or chat messages, to extract relevant information and automate order processing.

- Generative AI: Generative AI models can generate natural language text, automate report generation, and provide insights into trade patterns.

By leveraging Python, AI, and cloud platforms, firms can unlock the full potential of Order Entry and Management Automation, revolutionizing their operations and gaining a competitive advantage in the investment industry.

Building a Robust Order Entry and Management Automation System with Python and Cloud

Process Analysis and Automation

The Order Entry and Management Automation process involves several key subprocesses that can be automated using Python and cloud technologies:

- Order Intake: Python scripts can capture orders from various sources, such as FIX messages, emails, or web portals. Cloud-based storage services provide a centralized repository for order data.

- Order Validation: AI-powered algorithms analyze orders for errors, inconsistencies, and compliance with regulatory requirements. Cloud platforms offer scalable computing resources for complex validation tasks.

- Order Execution: Automated systems execute orders across multiple asset classes using Python scripts. Cloud platforms provide connectivity to various exchanges and trading venues.

- Order Management: Cloud-based solutions provide a centralized platform for tracking, managing, and monitoring orders throughout their lifecycle. Python scripts can be used to automate order updates, status notifications, and exception handling.

Data Security and Compliance

Data security and compliance are paramount in the investment industry. Python and cloud platforms offer robust security features to protect sensitive data:

- Encryption: Python libraries and cloud services provide encryption mechanisms to safeguard data at rest and in transit.

- Authentication and Authorization: Cloud platforms implement strict authentication and authorization protocols to control access to sensitive data and resources.

- Compliance Monitoring: Cloud platforms offer compliance monitoring tools to ensure adherence to industry regulations and standards.

Python vs. No-Code RPA/Workflow Tools

While no-code RPA/workflow tools offer a low-code/no-code approach to automation, Python provides several advantages:

- Customization: Python allows for highly customized automation solutions tailored to specific business requirements.

- Scalability: Python scripts can be easily scaled to handle large volumes of orders and complex workflows.

- Integration: Python integrates seamlessly with a wide range of applications and services, enabling end-to-end automation.

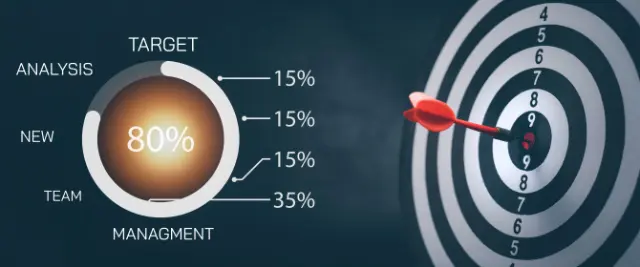

Algorythum’s Approach

Algorythum recognizes the limitations of off-the-shelf automation platforms and takes a different approach:

- Python-Based Solutions: Algorythum leverages Python’s flexibility and power to develop custom automation solutions that meet the unique needs of investment firms.

- Cloud-First Strategy: Algorythum embraces cloud technologies to provide scalable, reliable, and secure automation platforms.

- Focus on Client Satisfaction: Algorythum prioritizes client satisfaction by delivering tailored solutions that address specific challenges and drive measurable results.

By combining Python, cloud technologies, and a client-centric approach, Algorythum empowers investment firms to automate their Order Entry and Management processes effectively, enhancing efficiency, accuracy, and compliance.

The Future of Order Entry and Management Automation

The future of Order Entry and Management Automation holds exciting possibilities for the investment industry:

- Cognitive Automation: AI-powered cognitive automation systems can learn from historical data and make intelligent decisions, further enhancing accuracy and efficiency.

- Blockchain Integration: Blockchain technology can provide a secure and transparent platform for order execution and settlement, reducing counterparty risk and streamlining post-trade processes.

- Quantum Computing: Quantum computing has the potential to revolutionize order processing by enabling ultra-fast data analysis and optimization techniques.

Subscribe and Connect

Stay up-to-date with the latest trends and advancements in Order Entry and Management Automation by subscribing to our blog.

Contact our team today for a free feasibility assessment and cost estimate for your custom automation requirements. Let us help you unlock the full potential of Python, AI, and cloud technologies to transform your investment operations.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.