Position Reconciliation Automation: A Lifeline for the Investment Industry

The investment industry is a complex and fast-paced environment, where accurate and timely position reconciliation is crucial for portfolio accuracy and risk management. However, manual position reconciliation is a tedious and error-prone process, often involving multiple systems and data sources.

Position Reconciliation Automation using Python, AI, and cloud-based solutions offers a lifeline to investment firms by streamlining and automating this critical process. By leveraging the power of technology, firms can overcome the challenges of manual reconciliation and unlock a world of benefits, including:

- Increased efficiency: Automation significantly reduces the time and effort required for position reconciliation, freeing up resources for more value-added tasks.

- Improved accuracy: AI-powered reconciliation engines eliminate human errors, ensuring the highest level of data accuracy.

- Real-time insights: Cloud-based solutions provide real-time visibility into position data, enabling firms to make informed decisions and manage risk effectively.

With Position Reconciliation Automation, investment firms can gain a competitive edge by enhancing their operational efficiency, reducing costs, and mitigating risks. It’s time to embrace the future of position reconciliation and unlock the full potential of your investment portfolio.

Python, AI, and Cloud: The Power Trio for Position Reconciliation Automation

Unleashing the Power of Unattended Bots

Python is the ideal language for developing unattended bots for position reconciliation automation. These bots can run autonomously, 24/7, without human intervention. They can be programmed to perform a wide range of tasks, such as:

- Extracting data from multiple trading systems and custodians

- Matching positions across different accounts

- Identifying discrepancies and exceptions

- Generating reconciliation reports

Attended Bots: A Human-in-the-Loop Approach

Attended bots, also built with Python, work in collaboration with human users. They can assist with tasks such as:

- Validating reconciliation results

- Resolving exceptions

- Providing real-time updates on the reconciliation process

The level of customization available when building bots with Python allows firms to tailor their automation solutions to their specific needs and workflows.

Cloud Platforms: The Ultimate Orchestrators

Cloud platforms offer far more features and capabilities as automation orchestrators compared to traditional RPA/workflow tools. They provide:

- Scalability: Cloud platforms can handle large volumes of data and complex reconciliation tasks.

- Flexibility: Cloud platforms allow for easy integration with different trading systems and custodians.

- Security: Cloud platforms provide robust security measures to protect sensitive financial data.

AI: Enhancing Accuracy and Handling Edge Cases

AI can significantly improve the accuracy and efficiency of position reconciliation automation. AI techniques such as:

- Image recognition: Can be used to extract data from scanned documents or images of trade confirmations.

- Natural language processing (NLP): Can be used to interpret unstructured data, such as emails or chat messages, and identify relevant information.

- Generative AI: Can be used to generate synthetic data for testing and training reconciliation models.

By incorporating AI into their automation solutions, firms can handle even the most complex and challenging reconciliation tasks with confidence.

Building the Position Reconciliation Automation with Python and Cloud

Sub-Processes of Position Reconciliation Automation

The position reconciliation automation process can be broken down into the following sub-processes:

- Data Extraction: Extracting data from multiple trading systems and custodians.

- Data Matching: Matching positions across different accounts.

- Discrepancy Identification: Identifying discrepancies and exceptions.

- Reconciliation Reporting: Generating reconciliation reports.

Automating Sub-Processes with Python and Cloud

Each of these sub-processes can be automated using Python and cloud-based solutions. Here’s how:

1. Data Extraction:

– Use Python libraries to connect to trading systems and custodians via APIs or web scraping.

– Extract data into a structured format (e.g., CSV, JSON).

2. Data Matching:

– Use Python data manipulation libraries (e.g., Pandas) to compare and match positions across different accounts.

– Leverage cloud-based data processing services for large datasets.

3. Discrepancy Identification:

– Use Python conditional statements and exception handling to identify discrepancies and exceptions.

– Send alerts or notifications to relevant stakeholders.

4. Reconciliation Reporting:

– Use Python reporting libraries (e.g., Jinja2) to generate reconciliation reports.

– Store reports in a cloud-based repository for easy access and sharing.

Data Security and Compliance

Data security and compliance are of paramount importance in the investment industry. Python and cloud-based solutions provide robust security measures, such as:

- Encryption of data at rest and in transit

- Role-based access control

- Audit trails

Advantages of Python over No-Code RPA/Workflow Tools

While no-code RPA/workflow tools can be useful for simple automation tasks, Python offers several advantages for building complex and scalable position reconciliation automation solutions:

- Flexibility: Python is a general-purpose programming language that allows for greater customization and flexibility.

- Scalability: Python can handle large volumes of data and complex reconciliation tasks.

- Integration: Python can easily integrate with different trading systems, custodians, and cloud platforms.

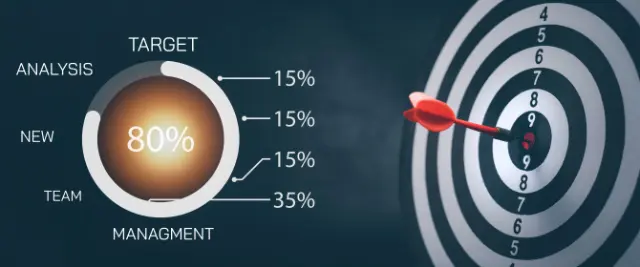

Algorythum’s Approach

Algorythum takes a different approach to position reconciliation automation because we understand the limitations of off-the-shelf automation platforms. Our Python-based solutions are:

- Tailor-made: We customize our solutions to meet the specific needs and workflows of each client.

- Scalable: Our solutions can handle large volumes of data and complex reconciliation tasks.

- Secure: We prioritize data security and compliance in all our solutions.

By partnering with Algorythum, investment firms can unlock the full potential of position reconciliation automation and gain a competitive edge in the industry.

The Future of Position Reconciliation Automation

The future of position reconciliation automation is bright, with emerging technologies offering exciting possibilities to further enhance the proposed solution.

Extended Capabilities

- Real-time reconciliation: Leveraging streaming data technologies to enable real-time reconciliation of positions.

- AI-powered anomaly detection: Using machine learning algorithms to identify anomalies and potential risks in reconciliation data.

- Blockchain integration: Utilizing blockchain technology to create a secure and immutable record of reconciliation transactions.

Integration with Other Systems

- Risk management systems: Integrating with risk management systems to provide a comprehensive view of portfolio risk.

- Performance measurement systems: Integrating with performance measurement systems to assess the impact of reconciliation accuracy on portfolio performance.

- Data analytics platforms: Integrating with data analytics platforms to gain insights from reconciliation data and improve decision-making.

Subscribe and Contact Us

To stay up-to-date on the latest advancements in position reconciliation automation and other industry-specific automation solutions, subscribe to our newsletter.

If you’re interested in exploring how Position Reconciliation Automation can benefit your investment firm, contact our team today for a free feasibility assessment and cost estimate. We’re here to help you unlock the full potential of automation and gain a competitive edge in the industry.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.