Overcoming Regulatory Reporting Challenges with AI-Powered Automation

In the ever-evolving investment landscape, regulatory reporting has become an increasingly complex and time-consuming task. Investment firms face the daunting challenge of adhering to a myriad of exchange and industry regulations, while ensuring accuracy and minimizing compliance errors. Regulatory Reporting Automation offers a transformative solution to these challenges, empowering firms to streamline their reporting processes, enhance efficiency, and mitigate risks.

Python-based Automations for Seamless Regulatory Reporting

Python, a versatile and powerful programming language, plays a pivotal role in Regulatory Reporting Automation. Its extensive libraries and frameworks provide the building blocks for developing robust and scalable automation solutions. Python-based automations can:

- Extract and transform data from disparate sources, ensuring consistency and completeness.

- Validate data against regulatory requirements, flagging potential errors and inconsistencies.

- Generate regulatory reports in the required format, adhering to industry standards.

- Automate the submission process, eliminating manual intervention and reducing the risk of errors.

Leveraging AI and Cloud for Enhanced Efficiency

Artificial Intelligence (AI) and cloud-based solutions further enhance the capabilities of Regulatory Reporting Automation. AI algorithms can analyze historical data to identify patterns and anomalies, improving the accuracy of reports. Cloud-based platforms provide scalability and flexibility, enabling firms to process large volumes of data and meet fluctuating reporting deadlines.

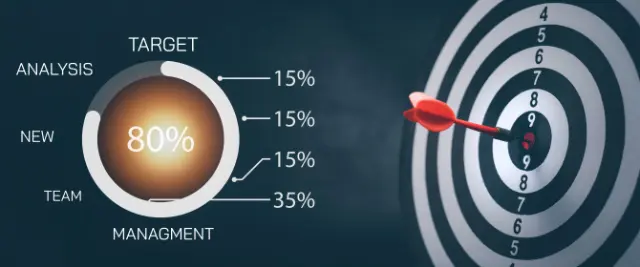

By embracing Regulatory Reporting Automation, investment firms can unlock significant benefits, including:

- Reduced operational costs and improved efficiency

- Enhanced accuracy and compliance

- Mitigation of risks and penalties

- Real-time reporting and improved decision-making

Embracing the Future of Regulatory Reporting

Regulatory Reporting Automation is not just a buzzword; it is a transformative force that is redefining the way investment firms manage their regulatory obligations. By leveraging Python, AI, and cloud-based solutions, firms can streamline their reporting processes, enhance accuracy, and gain a competitive edge in a rapidly evolving regulatory landscape.

Python, AI, and Cloud: The Cornerstones of Regulatory Reporting Automation

Unattended Bots: Automating Regulatory Reporting Tasks

Python excels in developing unattended bots, which can operate autonomously without human intervention. These bots can be programmed to perform repetitive and time-consuming tasks, such as:

- Extracting data from various sources, including spreadsheets, databases, and web pages

- Validating data against regulatory requirements

- Generating regulatory reports in the required format

- Submitting reports to regulatory bodies

Attended Bots: Enhancing Human-Bot Collaboration

Attended bots work alongside human users, providing assistance and automating specific tasks within the regulatory reporting process. Unlike unattended bots, attended bots require human interaction to initiate and guide their actions. This level of customization allows for:

- Automating data entry and validation tasks

- Providing real-time guidance and error checking

- Generating reports based on user-defined parameters

Cloud Platforms: Supercharging Automation Orchestration

Cloud platforms offer a comprehensive suite of features and capabilities that far surpass traditional RPA/workflow tools orchestrators. These platforms provide:

- Scalability: Cloud platforms can handle large volumes of data and fluctuating workloads, ensuring seamless automation even during peak reporting periods.

- Flexibility: Cloud platforms offer a wide range of services and tools, allowing for customized automation solutions tailored to specific regulatory requirements.

- Security: Cloud platforms implement robust security measures to protect sensitive data and ensure compliance with industry regulations.

AI: Enhancing Accuracy and Handling Edge Cases

AI techniques play a crucial role in improving the accuracy and efficiency of Regulatory Reporting Automation. Specific AI techniques that can be leveraged include:

- Image recognition: Identifying and extracting data from scanned documents or images

- Natural language processing (NLP): Analyzing and interpreting unstructured text data, such as emails or regulatory guidelines

- Generative AI: Generating human-readable reports or summaries based on complex data

By incorporating AI into Regulatory Reporting Automation, firms can:

- Improve the accuracy of data extraction and validation

- Handle complex and edge cases that may require human intervention

- Generate insights and identify trends from historical data

Conclusion

The combination of Python, AI, and cloud platforms empowers investment firms to achieve unprecedented levels of efficiency, accuracy, and compliance in their regulatory reporting processes. By embracing these technologies, firms can free up resources, mitigate risks, and gain a competitive edge in the ever-changing investment landscape.

Building the Regulatory Reporting Automation with Python and Cloud

Sub-processes in Regulatory Reporting Automation

The Regulatory Reporting Automation process can be broken down into several sub-processes:

- Data Extraction: Extracting data from various sources, including spreadsheets, databases, and web pages.

- Data Validation: Validating data against regulatory requirements and flagging potential errors or inconsistencies.

- Report Generation: Generating regulatory reports in the required format, adhering to industry standards.

- Report Submission: Submitting reports to regulatory bodies electronically or via other specified channels.

Automating Sub-processes with Python and Cloud

1. Data Extraction:

- Python: Use Python libraries like Pandas and BeautifulSoup to extract data from various sources.

- Cloud: Leverage cloud services like Google Cloud Storage or Amazon S3 to store and access data securely.

2. Data Validation:

- Python: Use Python libraries like NumPy and SciPy for data validation and error checking.

- Cloud: Utilize cloud-based data validation tools and services to ensure compliance with regulatory requirements.

3. Report Generation:

- Python: Use Python libraries like ReportLab or JasperReports to generate reports in the required format.

- Cloud: Leverage cloud-based reporting tools and services to automate report generation and distribution.

4. Report Submission:

- Python: Use Python libraries like requests or Selenium to submit reports electronically.

- Cloud: Integrate with cloud-based submission platforms to automate the submission process.

Importance of Data Security and Compliance

Data security and compliance are paramount in the investment industry. Python and cloud platforms provide robust security features to protect sensitive data and ensure compliance with industry regulations, such as:

- Encryption at rest and in transit

- Role-based access control

- Audit logging and monitoring

Advantages of Python over No-Code RPA/Workflow Tools

- Flexibility: Python allows for greater customization and flexibility in automation development.

- Scalability: Python can handle large volumes of data and complex automation tasks.

- Integration: Python can easily integrate with a wide range of cloud services and third-party applications.

Algorythum’s Approach

Algorythum takes a different approach to Regulatory Reporting Automation because we recognize the limitations of off-the-shelf automation platforms. Our Python-based approach offers:

- Tailor-made Solutions: We develop customized automation solutions that meet the specific requirements of each client.

- Performance and Scalability: Our Python-based automations are designed for high performance and scalability, ensuring seamless operation even during peak reporting periods.

- Data Security and Compliance: We prioritize data security and compliance, implementing industry-standard security measures to protect sensitive data.

By choosing Algorythum, investment firms can benefit from a comprehensive and tailored Regulatory Reporting Automation solution that streamlines their processes, enhances accuracy, and ensures compliance.

The Future of Regulatory Reporting Automation

The future of Regulatory Reporting Automation holds exciting possibilities for further enhancing the efficiency, accuracy, and compliance of regulatory reporting processes.

- Integration with Cognitive Technologies: Integrating cognitive technologies, such as natural language processing (NLP) and machine learning (ML), can enable automations to understand and interpret complex regulatory requirements, automate data extraction from unstructured sources, and identify patterns and trends in historical data.

- Real-Time Reporting: Leveraging real-time data streaming and analytics can enable firms to generate and submit regulatory reports in real time, providing up-to-date insights and facilitating timely decision-making.

- Blockchain for Secure Data Sharing: Utilizing blockchain technology can create a secure and immutable ledger for sharing regulatory data with auditors and other stakeholders, enhancing transparency and reducing the risk of data tampering.

Subscribe and Contact Us

Stay up-to-date on the latest Regulatory Reporting Automation trends and advancements by subscribing to our newsletter.

Contact our team of experts today for a free feasibility assessment and cost estimate tailored to your specific regulatory reporting requirements. Together, we can unlock the full potential of automation and transform your regulatory reporting processes.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.