Embracing Intelligent Trade Confirmation and Settlement Automation

In the fast-paced world of investment, streamlining post-trade operations is crucial for efficiency and accuracy. Traditional manual processes for trade confirmation and settlement can be cumbersome, prone to errors, and delay client fund movement.

Enter Trade Confirmation and Settlement Automation, a revolutionary approach that leverages Python, AI, and cloud-based solutions to automate these tasks. By embracing automation, investment firms can unlock significant benefits, including:

- Reduced operational costs: Automation eliminates the need for manual labor, freeing up resources for more strategic initiatives.

- Improved accuracy: Automated systems minimize human errors, ensuring the accuracy and integrity of trade confirmations and settlement instructions.

- Accelerated settlement: Automation speeds up the settlement process, reducing the time it takes for clients to receive their funds.

- Enhanced client satisfaction: Automated systems provide real-time updates on trade status, improving client visibility and satisfaction.

Python, AI, and Cloud: The Power Trio for Trade Confirmation and Settlement Automation

Python, AI, and cloud-based solutions play a pivotal role in Trade Confirmation and Settlement Automation, enabling the development of sophisticated unattended and attended bots.

Unattended Bots

Python’s robust libraries make it ideal for developing unattended bots that can automate repetitive tasks, such as:

- Extracting data from trade confirmations

- Generating settlement instructions

- Sending email notifications

These bots can run 24/7, ensuring that trade confirmations and settlements are processed promptly and accurately.

Attended Bots

Attended bots, also built with Python, assist human operators in completing tasks. For example, an attended bot can:

- Provide real-time guidance to operators on complex trade confirmations

- Automate data entry tasks, reducing the risk of errors

- Offer suggestions based on historical data and industry best practices

The level of customization available in Python allows attended bots to be tailored to the specific needs of each investment firm.

Cloud Platforms

Cloud platforms offer a powerful suite of features and capabilities that make them ideal for orchestrating Trade Confirmation and Settlement Automation. These platforms provide:

- Scalability to handle large volumes of trades

- Security to protect sensitive financial data

- Integration with other business systems

- Access to advanced AI and machine learning services

AI for Enhanced Accuracy and Edge-Case Handling

AI techniques, such as image recognition, natural language processing (NLP), and generative AI, can significantly improve the accuracy and efficiency of Trade Confirmation and Settlement Automation. These techniques can be used to:

- Automatically extract data from complex trade confirmations

- Identify and handle edge cases that may require human intervention

- Continuously improve the automation process by learning from historical data

By leveraging the power of Python, AI, and cloud platforms, investment firms can unlock the full potential of Trade Confirmation and Settlement Automation, streamlining post-trade operations and delivering exceptional client service.

Building the Trade Confirmation and Settlement Automation: Automate trade confirmation generation and settlement processing, streamlining post-trade tasks and accelerating client fund movement. with Python and Cloud

The automation of trade confirmation and settlement processes involves several key sub-processes, each of which can be automated using Python and cloud-based solutions.

-

Data Extraction: Python’s powerful libraries, such as Pandas and BeautifulSoup, can be used to extract data from trade confirmations and other relevant documents.

-

Settlement Instruction Generation: Once the data has been extracted, Python can be used to generate settlement instructions in the appropriate format.

-

Email Notification: Python can be used to send email notifications to relevant parties, such as clients and custodians, to inform them of the status of trade confirmations and settlements.

-

Exception Handling: Python can be used to handle exceptions that may occur during the automation process. For example, if a trade confirmation cannot be processed due to missing data, Python can be used to send an alert to the appropriate personnel.

It is important to ensure that data security and compliance are maintained throughout the automation process. Python provides a number of features that can be used to protect sensitive financial data, such as encryption and access control.

Advantages of Python over No-Code RPA/Workflow Tools:

- Flexibility: Python is a versatile language that can be used to automate a wide range of tasks. This makes it ideal for automating complex trade confirmation and settlement processes.

- Scalability: Python can be used to automate large volumes of trades, making it suitable for even the most demanding investment firms.

- Integration: Python can be easily integrated with other business systems, such as CRM and ERP systems. This allows for the creation of end-to-end automated workflows.

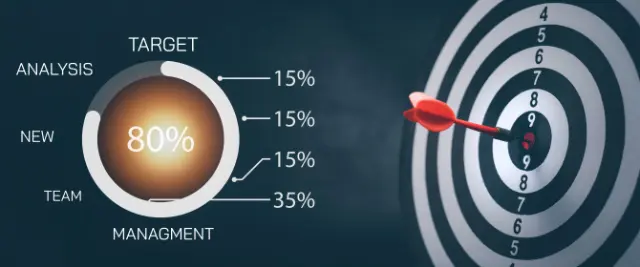

Algorythum’s Approach:

Algorythum takes a different approach to Trade Confirmation and Settlement Automation than most BPA companies. We believe that off-the-shelf automation platforms are often too rigid and inflexible to meet the specific needs of investment firms. Our approach is to use Python and cloud-based solutions to build custom automation solutions that are tailored to the unique requirements of each client. This approach has resulted in significant client satisfaction, as our clients have experienced improved efficiency, accuracy, and compliance.

The Future of Trade Confirmation and Settlement Automation

The future of Trade Confirmation and Settlement Automation is bright. As technology continues to evolve, new possibilities will emerge to further enhance the efficiency and accuracy of these processes.

One area of future development is the use of artificial intelligence (AI) to automate even more complex tasks. For example, AI could be used to:

- Identify and resolve discrepancies between trade confirmations and settlement instructions

- Predict settlement dates based on historical data

- Generate settlement instructions in multiple languages

Another area of future development is the use of blockchain technology to create a secure and transparent record of trade confirmations and settlements. This would eliminate the need for paper-based confirmations and reduce the risk of fraud.

Algorythum is committed to staying at the forefront of these technological advancements and incorporating them into our Trade Confirmation and Settlement Automation solutions. We encourage you to subscribe to our newsletter to stay up-to-date on the latest developments in this field.

If you are interested in learning more about how Algorythum can help you automate your trade confirmation and settlement processes, please contact us today for a free feasibility and cost-estimate.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.