Challenges of Loan Restructuring & Modification Automation

In the lending industry, loan restructuring and modification are critical processes that require precision and timeliness. However, these processes often involve complex calculations and document generation, which can be prone to errors and delays when done manually.

Loan Restructuring & Modification Automation: A Path to Efficiency and Accuracy

With the advent of advanced technologies like Python, AI, and cloud-based solutions, automating loan restructuring and modification processes has become a game-changer. By leveraging these technologies, lenders can streamline these processes, enhance accuracy, and improve overall efficiency.

Python, AI, and Cloud’s Role in Loan Restructuring & Modification Automation

Unleashing the Power of Unattended Bots

Python’s robust capabilities make it the ideal choice for developing unattended bots that can automate repetitive and rule-based tasks in loan restructuring and modification processes. These bots can work autonomously, without human intervention, ensuring consistent and error-free execution.

Enhanced Capabilities with Attended Bots

In scenarios where human intervention is necessary, attended bots extend the automation capabilities even further. Built with Python, these bots provide real-time assistance to loan officers, guiding them through complex tasks and automating data entry and calculations. The level of customization available in Python-built bots empowers lenders to tailor automation to their specific requirements.

Cloud Platforms: Supercharging Automation Orchestration

Cloud platforms offer a comprehensive suite of features and capabilities that far surpass traditional RPA/workflow tools. With their vast compute power, storage capacity, and advanced AI services, cloud platforms can serve as powerful automation orchestrators. They allow for seamless integration of various automation components, enabling the creation of end-to-end automation workflows.

AI: Enhancing Accuracy and Handling Edge Cases

AI technologies play a crucial role in improving the accuracy and handling edge cases in loan restructuring and modification automation. Techniques like image recognition can automate document processing, while natural language processing (NLP) can extract and analyze loan data from various sources. Generative AI, such as GPT-3, can generate custom documents and provide real-time guidance to loan officers, making the automation process even more powerful and comprehensive.

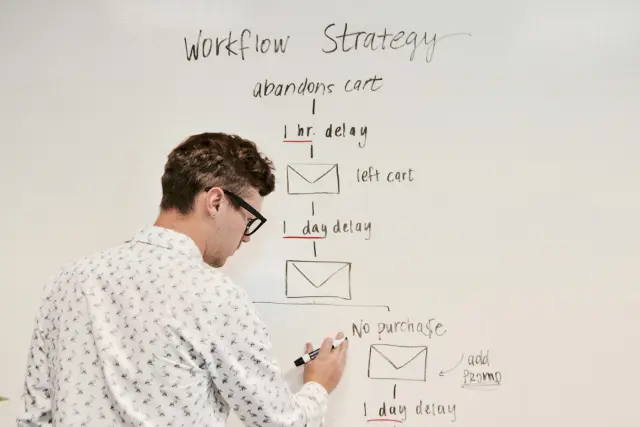

Building the Loan Restructuring & Modification Automation

Step-by-Step Automation Development with Python and Cloud

-

Process Analysis: Identify and analyze the individual sub-processes involved in loan restructuring and modification, such as data collection, calculations, document generation, and approval workflows.

-

Python Script Development: Develop Python scripts for each sub-process, leveraging libraries for data manipulation, calculations, and document generation.

-

Cloud Integration: Integrate the Python scripts with a cloud platform to orchestrate the automation workflow, manage data storage, and provide scalability.

-

Data Security and Compliance: Implement robust security measures to protect sensitive loan data and ensure compliance with industry regulations.

Python vs. No-Code RPA/Workflow Tools

While no-code RPA/workflow tools offer a low-code/no-code approach to automation, they often lack the flexibility and customization capabilities of Python. Python provides greater control over the automation process, allowing for tailored solutions that meet the specific requirements of loan restructuring and modification.

Algorythum’s Python-Based Approach: Addressing Client Dissatisfaction

Algorythum takes a different approach to automation, witnessing client dissatisfaction with the performance of off-the-shelf automation platforms. Our Python-based approach empowers clients to:

- Build Custom Solutions: Develop tailored automation solutions that align precisely with their unique business processes and requirements.

- Enhance Scalability: Leverage the scalability of cloud platforms to handle increasing loan volumes and complex restructuring scenarios.

- Improve Accuracy and Efficiency: Utilize AI techniques to enhance accuracy and automate complex calculations, reducing errors and processing time.

- Ensure Data Security: Implement robust security measures to protect sensitive loan data and maintain compliance with industry regulations.

The Future of Loan Restructuring & Modification Automation

The future of loan restructuring and modification automation holds exciting possibilities for further enhancements and technological advancements. By embracing emerging technologies and fostering collaboration within the industry, we can push the boundaries of what’s possible:

- AI-Driven Decision-Making: Leverage AI and machine learning algorithms to analyze historical data and provide insights for optimal loan restructuring and modification strategies.

- Blockchain for Secure Data Sharing: Explore blockchain technology to create a secure and auditable platform for sharing loan data among stakeholders.

- Robotic Process Automation (RPA) for Enhanced Efficiency: Integrate RPA with existing automation solutions to streamline repetitive and time-consuming tasks, further increasing efficiency and reducing operational costs.

Subscribe and Contact Us

Stay up-to-date with the latest trends and innovations in loan restructuring and modification automation by subscribing to our newsletter. For a personalized consultation and a free feasibility and cost-estimate for your custom automation requirements, contact our team of experts today.

Let’s collaborate to shape the future of Loan Restructuring & Modification Automation and empower the lending industry with cutting-edge solutions.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.