Loan Modification Automation: Empowering Lenders to Humanize the Lending Process

In the lending industry, loan modification automation is not just a buzzword; it’s a necessity. With the surge in loan modification requests due to financial hardships, lenders are facing immense pressure to process these requests efficiently and accurately. Manual processes are no longer sustainable, leading to delays, errors, and a less-than-ideal customer experience.

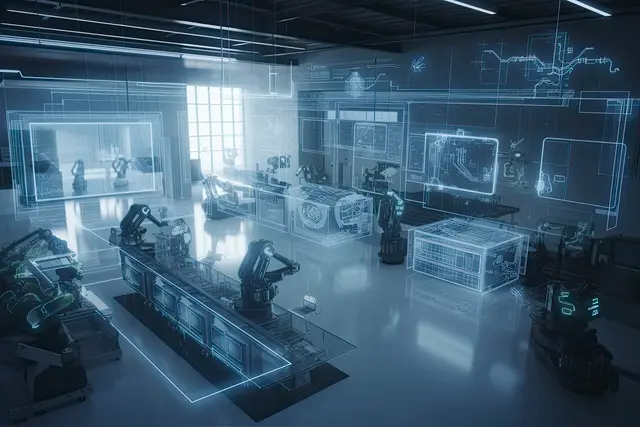

Python, AI, and cloud-based solutions offer a beacon of hope in this scenario. By automating loan modification processes, lenders can streamline operations, reduce turnaround times, and improve the overall customer experience. Loan Modification Automation empowers lenders to make data-driven decisions, analyze borrower circumstances, and propose modified payment terms with precision. It’s a win-win situation, allowing lenders to meet regulatory requirements while providing borrowers with the support they need during challenging times.

Python, AI, and Cloud: The Power Trio for Loan Modification Automation

Unattended Bots: The Silent Workhorses

Python excels in developing unattended bots that can tirelessly execute repetitive tasks involved in loan modification automation. These bots can:

- Review and analyze borrower documentation: Extract key data from loan applications, financial statements, and other supporting documents.

- Assess income changes: Analyze borrower income and identify any significant fluctuations that may warrant loan modification.

- Simulate modified payment terms: Generate various payment scenarios and calculate the impact on the borrower’s financial situation.

- Prepare and process paperwork: Automatically generate and update loan agreements and account structures based on approved modifications.

Attended Bots: Empowering Human-Bot Collaboration

Attended bots provide real-time assistance to loan officers, enhancing their productivity and accuracy. Built with Python, these bots can:

- Guide loan officers through complex processes: Provide step-by-step instructions and offer suggestions based on predefined rules.

- Extract data from disparate systems: Gather information from multiple sources, such as core banking systems and document management platforms.

- Automate data entry tasks: Eliminate manual data entry errors and save valuable time for loan officers.

- Enable real-time decision-making: Provide loan officers with immediate access to relevant data and insights, empowering them to make informed decisions on the spot.

Cloud Platforms: The Orchestration Powerhouse

Cloud platforms offer a comprehensive suite of features that surpass the capabilities of traditional RPA/workflow tools. These platforms provide:

- Scalability and elasticity: Handle fluctuating workloads and process large volumes of loan modification requests efficiently.

- Integration capabilities: Seamlessly integrate with core banking systems, document management platforms, and other enterprise applications.

- Advanced analytics and reporting: Generate insightful reports and dashboards to track automation performance and identify areas for improvement.

AI: The Intelligence Booster

AI techniques, such as image recognition, natural language processing (NLP), and Generative AI (Gen AI), can significantly enhance the accuracy and efficiency of loan modification automation. These techniques can:

- Automate document classification: Identify and categorize loan-related documents, such as income statements and bank statements.

- Extract unstructured data: Parse handwritten notes, free-form text, and unstructured data from various sources.

- Identify fraud and discrepancies: Detect potential fraud or inconsistencies in borrower documentation through advanced pattern recognition algorithms.

- Generate personalized recommendations: Analyze borrower circumstances and suggest tailored loan modification options based on their unique financial situation.

By leveraging the power of Python, AI, and cloud platforms, lenders can transform their loan modification processes, improve operational efficiency, and provide a superior customer experience.

Building the Loan Modification Automation Engine

Developing a robust loan modification automation solution using Python and cloud involves several key steps:

1. Process Analysis and Design:

- Identify and analyze the sub-processes involved in loan modification, including document review, income assessment, payment simulation, and paperwork processing.

- Design the automation workflow, defining the sequence of steps and the data flow between them.

2. Data Extraction and Integration:

- Develop Python scripts to extract data from various sources, such as loan applications, financial statements, and core banking systems.

- Integrate with cloud-based document management platforms to automate the retrieval and processing of loan-related documents.

3. Income Assessment and Simulation:

- Use Python libraries for financial analysis to assess borrower income and identify changes that may warrant loan modification.

- Develop automated simulations to generate various payment scenarios and calculate the impact on the borrower’s financial situation.

4. Document Generation and Processing:

- Create Python scripts to generate customized loan modification agreements and other necessary paperwork based on approved modifications.

- Automate the processing of these documents within the cloud platform, including electronic signatures and document storage.

Security and Compliance:

Data security and compliance are paramount in the lending industry. Python and cloud platforms provide robust security features, such as encryption, access controls, and audit trails, to ensure the confidentiality and integrity of sensitive borrower data.

Advantages of Python over No-Code RPA/Workflow Tools:

- Flexibility and Customization: Python offers unparalleled flexibility and customization options, allowing for the development of tailored automation solutions that meet the specific requirements of the lending institution.

- Scalability and Performance: Python is a powerful and scalable language that can handle large volumes of data and complex calculations, ensuring efficient and reliable automation.

- Integration Capabilities: Python seamlessly integrates with a wide range of cloud platforms, databases, and third-party applications, enabling end-to-end automation across disparate systems.

Algorythum’s Approach:

Algorythum recognizes the limitations of off-the-shelf automation platforms and takes a Python-based approach to loan modification automation. This approach empowers our clients with:

- Tailor-made Solutions: Custom-built automation solutions that align precisely with their unique business processes and regulatory requirements.

- Unmatched Performance: High-performance automation engines that process loan modification requests swiftly and accurately, reducing turnaround times and improving customer satisfaction.

- Complete Control and Ownership: Full ownership and control over the automation code, ensuring transparency and the ability to adapt to changing business needs.

The Future of Loan Modification Automation

The convergence of Python, AI, and cloud platforms opens up a world of possibilities for enhancing loan modification automation. Here are a few potential future developments:

- Cognitive Automation: Leveraging AI techniques, such as natural language processing (NLP) and machine learning, to automate complex decision-making tasks, such as assessing borrower eligibility and determining appropriate loan modifications.

- Blockchain Integration: Utilizing blockchain technology to create a secure and transparent platform for loan modification processing, enabling real-time collaboration between lenders and borrowers.

- Robotic Process Discovery (RPD): Employing RPD tools to continuously analyze and optimize loan modification processes, identifying areas for further automation and efficiency gains.

Subscribe to Algorythum for Industry-Specific Insights

Stay ahead of the automation curve by subscribing to Algorythum. Our blog provides valuable insights into the latest automation trends and best practices in the lending industry.

Contact Us for a Free Feasibility and Cost Estimate

Are you ready to transform your loan modification processes? Contact the Algorythum team today for a free feasibility assessment and cost estimate. Our experts will work with you to design and implement a custom automation solution tailored to your specific requirements. Together, we can unlock the full potential of Loan Modification Automation and elevate the customer experience in the lending industry.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.