Revolutionizing Financial Reporting and Analysis in Retail with Python, AI, and the Cloud

In the fast-paced retail industry, financial reporting and analysis are crucial for informed decision-making and maximizing profitability. However, manual processes can be time-consuming, error-prone, and hinder the timely delivery of accurate insights.

Financial Reporting and Analysis Automation: A Game-Changer for Retail

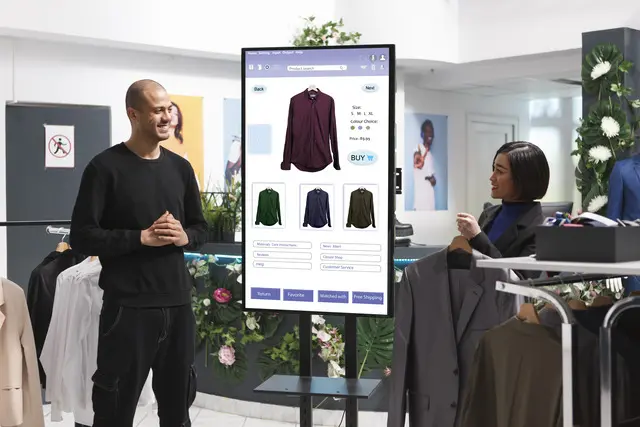

To address these challenges, forward-thinking retailers are embracing automation to streamline their financial reporting and analysis processes. By leveraging the power of Python, Artificial Intelligence (AI), and cloud-based solutions, retailers can unlock a world of benefits:

- Enhanced efficiency: Automate repetitive tasks, freeing up valuable time for strategic analysis and decision-making.

- Improved accuracy: Eliminate manual errors and ensure consistent, reliable financial reporting.

- Real-time insights: Access up-to-date financial data and generate reports on demand, empowering retailers to make informed decisions quickly.

Python, AI, and Cloud: The Power Trio for Financial Reporting and Analysis Automation

Unleashing the Power of Python for Automation

Python’s versatility and extensive libraries make it an ideal choice for developing unattended bots for financial reporting and analysis automation. These bots can seamlessly integrate with various data sources, such as accounting software, point-of-sale systems, and bank statements, to gather and process financial data. By automating repetitive tasks like data extraction, reconciliation, and report generation, unattended bots free up valuable time for finance professionals to focus on strategic analysis and decision-making.

Empowering Attended Bots with Python’s Customization

Attended bots, on the other hand, provide real-time assistance to human users during financial reporting and analysis tasks. Built with Python, attended bots offer a high level of customization, allowing them to be tailored to specific workflows and user preferences. This flexibility empowers finance teams to streamline their processes even further, enhancing efficiency and productivity.

Cloud Platforms: The Orchestration Powerhouse

Cloud platforms offer a comprehensive suite of features and capabilities that far surpass traditional RPA/workflow tools orchestrators. Their scalability, reliability, and advanced analytics capabilities make them ideal for managing complex financial reporting and analysis automation processes. Additionally, cloud platforms provide seamless integration with a wide range of applications and data sources, enabling end-to-end automation across the entire financial reporting and analysis lifecycle.

AI: Enhancing Accuracy and Handling Complexity

AI plays a crucial role in improving the accuracy and efficiency of financial reporting and analysis automation. Techniques like image recognition can automate the extraction of data from invoices and receipts, while natural language processing (NLP) can analyze unstructured text documents, such as financial reports and emails. Generative AI can even generate reports and insights based on the analyzed data, providing valuable decision support to finance teams. By leveraging AI’s capabilities, automation can handle complex and time-consuming tasks with greater precision and speed.

Building the Financial Reporting and Analysis Automation Engine: A Step-by-Step Guide

Step 1: Data Gathering and Integration

- Leverage Python’s data extraction capabilities to gather financial data from diverse sources, such as accounting software, POS systems, and bank statements.

- Utilize cloud platforms to seamlessly integrate with these data sources, ensuring real-time data availability for automation.

Step 2: Account Reconciliation

- Automate account reconciliation using Python’s data analysis and comparison capabilities.

- Employ cloud platforms for parallel processing and faster reconciliation, reducing manual effort and errors.

Step 3: Expense Categorization

- Train AI models using Python to categorize expenses accurately based on predefined rules or machine learning algorithms.

- Integrate these models with cloud platforms to handle large volumes of transactions efficiently.

Step 4: Report Generation

- Utilize Python’s reporting libraries to generate standardized financial reports, such as income statements, balance sheets, and cash flow statements.

- Leverage cloud platforms to automate report distribution and sharing with stakeholders.

Step 5: Data Security and Compliance

- Implement robust security measures in Python and cloud platforms to protect sensitive financial data.

- Ensure compliance with industry regulations and standards throughout the automation process.

Advantages of Python over No-Code RPA/Workflow Tools:

- Flexibility and Customization: Python offers unparalleled flexibility to tailor automation solutions to specific business requirements.

- Scalability and Performance: Python’s scalability and cloud integration enable efficient handling of large datasets and complex processes.

- AI Integration: Python’s AI capabilities provide advanced data analysis and decision support, enhancing the accuracy and effectiveness of automation.

Algorythum’s Python-Based Approach: Addressing Client Dissatisfaction

Algorythum’s focus on Python-based automation stems from our recognition of client dissatisfaction with off-the-shelf RPA tools. These tools often lack the flexibility, scalability, and AI integration required for robust financial reporting and analysis automation. By leveraging Python and cloud platforms, Algorythum delivers custom-tailored solutions that meet the unique challenges and requirements of each client.

The Future of Financial Reporting and Analysis Automation

The convergence of Python, AI, and cloud technologies is rapidly transforming the landscape of financial reporting and analysis automation. As these technologies continue to evolve, we can expect even more innovative and powerful solutions to emerge.

Potential Future Enhancements:

- Real-Time Analysis and Predictive Insights: AI-powered automation can provide real-time analysis of financial data, enabling retailers to identify trends, forecast performance, and make proactive decisions.

- Automated Audit and Compliance: Automation can extend to audit and compliance processes, ensuring accuracy and adherence to regulatory requirements.

- Integration with ERP and BI Systems: Seamless integration with ERP and BI systems will provide a comprehensive view of financial data and enable end-to-end automation across the entire finance function.

Subscribe and Contact Us:

To stay abreast of the latest advancements in financial reporting and analysis automation, subscribe to our newsletter for industry-specific insights and automation updates.

Contact our team today for a free feasibility assessment and cost estimate tailored to your unique requirements. Together, we can unlock the full potential of automation to drive efficiency, accuracy, and growth for your retail business.

Algorythum – Your Partner in Automations and Beyond

At Algorythum, we specialize in crafting custom RPA solutions with Python, specifically tailored to your industry. We break free from the limitations of off-the-shelf tools, offering:

- A team of Automation & DevSecOps Experts: Deeply experienced in building scalable and efficient automation solutions for various businesses in all industries.

- Reduced Automation Maintenance Costs: Our code is clear, maintainable, and minimizes future upkeep expenses (up to 90% reduction compared to platforms).

- Future-Proof Solutions: You own the code, ensuring flexibility and adaptability as your processes and regulations evolve.